Question: Mutually exclusive projects Ocean Pacific Restaurant is evaluating two mutually exclusive projects for expanding the restaurants seating capacity. The relevant cash flows for the projects

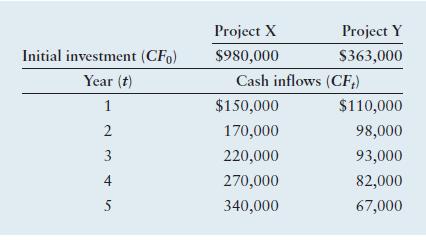

Mutually exclusive projects Ocean Pacific Restaurant is evaluating two mutually exclusive projects for expanding the restaurant’s seating capacity. The relevant cash flows for the projects are shown in the following table. The firm’s cost of capital is 4%.

a. Calculate the IRR to the nearest whole percent for each of the projects.

b. Assess the acceptability of each project on the basis of the IRRs found in part a.

c. Which project, on this basis, is preferred?

Initial investment (CFO) Year (t) 1 2 3 4 5 30 Project X $980,000 Project Y $363,000 Cash inflows (CF) $150,000 170,000 220,000 270,000 340,000 $110,000 98,000 93,000 82,000 67,000

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

To calculate the internal rate of return IRR for Project X and Project Y we find the discount rate that makes the net present value NPV of the cash fl... View full answer

Get step-by-step solutions from verified subject matter experts