Operating cash inflows MSC Cruises provides cruise lines for tourist destinations all around the world. It is

Question:

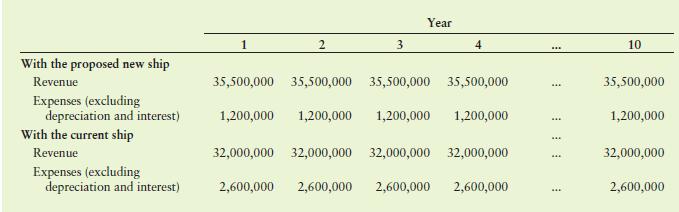

Operating cash inflows MSC Cruises provides cruise lines for tourist destinations all around the world. It is considering replacing one of its cruise ships with a new model. The existing cruise ship was bought five years ago at a total cost of €250,000,000 and is being depreciated using straight-line depreciation over a 10-year period. The new ship would have larger passenger capacity and better fuel efficiency as well as lower maintenance cost. Its cost is €300,000,000, and would be depreciated using straight line depreciation over a 10-year period. MSC is subject to a tax rate of 24%. The firm estimates the revenues and cash expenses (excluding depreciation and interest) for the proposed purchase as well as the old ship to be as shown in the accompanying table. Use the information to calculate the operating cash flows for the proposed cruise ship replacement.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart