PD Fishing Limited is attempting to determine whether to lease or purchase a new fishing boat for

Question:

PD Fishing Limited is attempting to determine whether to lease or purchase a new fishing boat for its crab business in Langkawi, Malaysia. The firm is in the 25% tax bracket, and its after-tax cost of debt is currently 10%. The terms of the lease and of the purchase are as follows:

Lease Annual end-of-year lease payments of Malaysian ringgit (RM) 120,000 are required over the three-year life of the lease. All maintenance costs will be paid by the lessor; insurance and other costs will be borne by the lessee.

The lessee will exercise its option to purchase the asset for RM 24,000 at termination of the lease.

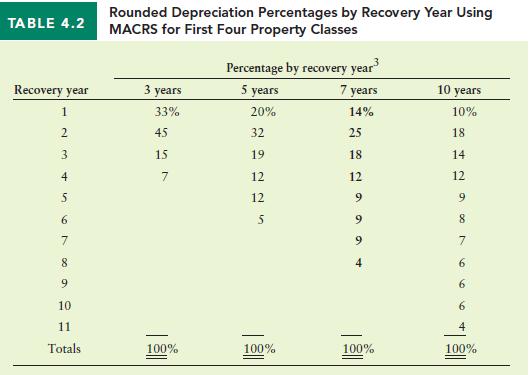

Purchase The boat costs RM 300,000 and can be financed with a 12% loan requiring annual end-of-year payments of RM 125,000 for three years. PD will depreciate the boat under MACRS using a three-year recovery period. (See Table 4.2 for the applicable depreciation percentages.) PD will pay RM 54,000 per year for a service contract that covers all maintenance costs; insurance and other costs will be borne by the PD, who plans to keep the boat and use it beyond its three-year recovery period.

a. Calculate the after-tax cash outflows associated with each alternative.

b. Calculate the present value of each stream, using the after-tax cost of debt.

c. Based on your analysis in parts a and b, which alternative—lease or purchase—would you recommend? Why?

Data from Table 4.2

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart