Peabody & Peabody has 2019 sales of $10 million. It wishes to analyze expected performance and financing

Question:

Peabody & Peabody has 2019 sales of $10 million. It wishes to analyze expected performance and financing needs for 2021, which is 2 years ahead. Given the following information, respond to parts a and b.

(1) The percent of sales for items that vary directly with sales are as follows:

Accounts receivable, 12%

Inventory, 18%

Accounts payable, 14%

Net profit margin, 3%

(2) Marketable securities and other current liabilities are expected to remain unchanged.

(3) A minimum cash balance of $480,000 is desired.

(4) A new machine costing $650,000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $290,000, and in 2021 $390,000 of depreciation will be taken.

(5) Accruals are expected to rise to $500,000 by the end of 2021.

(6) No sale or retirement of long-term debt is expected.

(7) No sale or repurchase of common stock is expected.

(8) The dividend payout of 50% of net profits is expected to continue.

(9) Sales are expected to be $11 million in 2020 and $12 million in 2021.

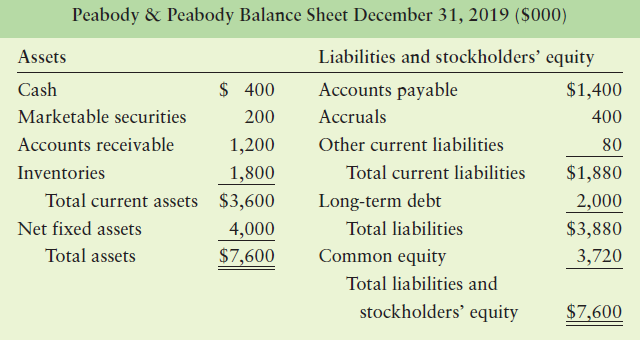

(10) The December 31, 2019, balance sheet follows.

a. Prepare a pro forma balance sheet dated December 31, 2021.

b. Discuss the financing changes suggested by the statement prepared in part a.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart