Rate of return, standard deviation, and coefficient of variation Jelena is searching for an IT stock to

Question:

Rate of return, standard deviation, and coefficient of variation Jelena is searching for an IT stock to include in her current stock portfolio. She is interested in Perin Technologies; she believes that Perin is an innovative market player. However, Jelena realizes that any time you consider a technology stock, risk is a major concern.

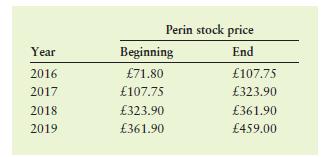

The rule she follows is to include only securities with a coefficient of variation of returns below 0.85. Jelena has obtained the following price information for Perin stock. Perin has not paid any dividends during these four years following a high growth strategy.

a. Calculate the rate of return for each year.

b. Calculate the average return over time.

c. Calculate the standard deviation over the past four years.

d. Based on parts b and

c, determine the coefficient of variation for the security.

e. Given the calculation in part

d, what should be Jelena’s decision regarding the inclusion of Perin stock in her portfolio?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart