Research Clinic purchased a blood-testing machine 4 years ago for $96,000. It is being depreciated under MACRS

Question:

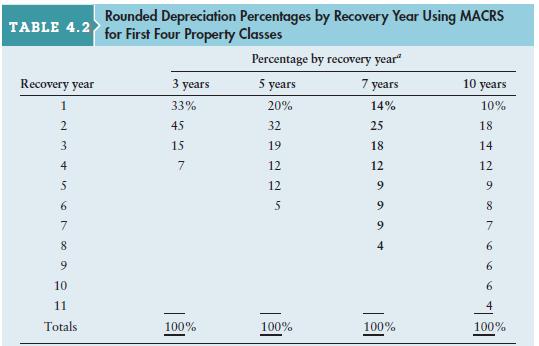

Research Clinic purchased a blood-testing machine 4 years ago for $96,000. It is being depreciated under MACRS with a 7-year recovery period using the percentages given in Table 4.2 on page 166. Assume a 30% tax rate.

Table 4.2:

a. What is the book value of the blood-testing machine?

a. What is the book value of the blood-testing machine?

b. Calculate the clinic’s tax liability if it sold the blood-testing machine for each of the following amounts: $120,000; $26,000; $231,200; and $21,000.

Transcribed Image Text:

TABLE 4.2 Recovery year 1 2 3 4 56700 8 9 10 11 Totals Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes 3 years 33% 45 15 7 100% Percentage by recovery year" 5 years 7 years 20% 14% 25 18 12 32 19 225 12 12 100% 9 9 9 100% 10 years 10% 18. 14 12 9 8 7 6 6 6 100%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

To calculate the ...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

Consider this 5 number summary for a 22point quiz given to a class. 5, 12, 14, 17, 21 What percentage of students earned 17points or more on the quiz? Answer: Pregnancies from contraception to birth...

-

Troy Industries purchased a new machine 3 years ago for $80,000. It is being depreciated under MACRS with a 5-year recovery period using the percentages given in Table 4.2. Assume a 40% tax rate. a....

-

For each of the following two situations explain whether XCo. and YCo. are ASSOCIATED? Bob owns 60% of XCo. and Marvin, Bob's friend, owns the remaining 40%. Bob owns 30% of YCo. and David, Bob's...

-

International Microcircuits, Inc. Megan Bedding, vice-president of sales for International Microcircuits, Inc. (IM), was delighted when IM was one of the few firms invited to enter a bid to supply a...

-

Earthquake, drought, fire, economic famine, flood, and a pestilence of TV court reporters have caused an exodus from the City of Angels to Boulder, Colorado. The sudden increase in demand is...

-

You have been asked by your boss to write a brief description of what the control activities should be as part of the development of a strong internal control system in your office. You know that the...

-

Prove that the matrices $\mathbf{H}$ and $\mathbf{I}-\mathbf{H}$ are idempotent, that is, $\mathbf{H H}=\mathbf{H}$ and $(\mathbf{I}-\mathbf{H})(\mathbf{I}-\mathbf{H})=\mathbf{I}-\mathbf{H}$.

-

Sandra Lerner and Patricia Holmes were friends. One evening, while applying nail polish to Lerner, Holmes layered a raspberry color over black to produce a new color, which Lerner liked. Later, the...

-

Information of call and put options of Tencent (00700.hk) on 1 April 2022 shown as the table. Tencent's stock price is trading at $385.00 Both call and put options will be expired on 28 April 2022....

-

The pesticide Atrazine (C 8 H 14 C1N 5 , mol wt. 216 g/ mol) degrades in soil by a first-order reaction process. Consider the situation shown in the figure below, where there is a spill of solid...

-

Colorado Cleaning has a 5-year maximum acceptable payback period. The firm is considering the purchase of a new washing machine and must choose between two alternative ones. The first machine...

-

A few years ago, Tasty Food Company purchased an automatic production line at an installed cost of $325,000. The company has recognized depreciation expenses totaling $215,250 since its installation....

-

Print a blank 50 15 spreadsheet on construction paper, and then cut the printed cells into 25 rectangles of varying size, some with just a few cells and some with many. Ask a few friends to pick a...

-

What are the three kinds of control structure in Structured English?

-

How does a communication diagram differ from a class diagram?

-

Give a counterexample to show that the converse of the statement is false. If \(m\) is divisible by 9 and 4 , then \(m\) is divisible by 12 .

-

To estimate the concentration of a certain type of bacterium in a wastewater sample, a microbiologist puts a \(0.5 \mathrm{~mL}\) sample of the wastewater on a microscope slide and counts 39...

-

Consider the control strategy structures shown in Fig. D1.5 (a) and (b). Given nominal value of \(K=1\), show that both have same transfer function \(C(s) / X(s)\). Evaluate \(\left|S_{K}^{T} ight|\)...

-

Explain the law of diminishing returns. How does it relate to the cost of labor?

-

The registrar of a college with a population of N = 4,000 full-time students is asked by the president to conduct a survey to measure satisfaction with the quality of life on campus. The following...

-

You have been given the expected return data shown in the first table on three assets'F, G, and H'over the period 20132016. Using these assets, you have isolated the three investment alternatives...

-

You have been given the expected return data shown in the first table on three assets'F, G, and H'over the period 20132016. Using these assets, you have isolated the three investment alternatives...

-

Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation: perfect positive, uncorrelated, and...

-

Roadside Inc is fine-tuning a combination flashlight / WiFi hotspot. The new product would sell for $36.32. Variable cost of production would be $14.83 per unit. Setting up production would entail...

-

10 Trixie has $300,000 to invest and has the following two investment options: (1) investing or borrowing at the riskless rate of 3%, and (2) a stock portfolio that has an expected return of 9%/year...

-

You will watch the video Dr. Ladson-Billings share information on culturally relevant pedagogy in the Building Culturally Relevant Schools Post-Pandemic webinar. While watching, you should have a pen...

Study smarter with the SolutionInn App