Sheldon Enterprises is considering a merger with Weldon Enterprises by swapping 1.5 shares of its stock for

Question:

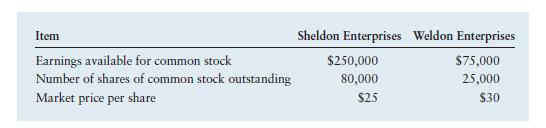

Sheldon Enterprises is considering a merger with Weldon Enterprises by swapping 1.5 shares of its stock for each share of Weldon Enterprises stock. Sheldon Enterprises expects that its stock will sell at the same price earnings (P/E) multiple after the merger as before the merger. Data about Sheldon Enterprises and Weldon Enterprises are provided in the following table.

a. Calculate the ratio of exchange in market price.

b. Calculate the price/earnings (P/E) ratio for each firm.

c. Calculate the price/earnings (P/E) ratio applicable in the acquisition.

d. Calculate the postmerger earnings per share (EPS) for Sheldon Enterprises.

e. What is the expected market price per share of the merged firm? Explain why this is the case.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter