Sweet Taters Corporation is considering the acquisition of a new cooking machine. The initial investment (CF0) estimate

Question:

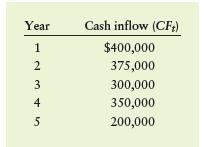

Sweet Taters Corporation is considering the acquisition of a new cooking machine. The initial investment (CF0) estimate is $2.52 million. The machine purchased will have a five-year life with no salvage value. Using a 10% discount rate, determine the net present value (NPV) of the machine given its expected operating cash inflows shown in the following table. Based on the project’s NPV, should Sweet Taters Corporation make this investment?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart

Question Posted: