Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC), one of the worlds largest semiconductor foundries, is considering building a

Question:

Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC), one of the world’s largest semiconductor foundries, is considering building a new production facility close to one of its main business partners. Once the facility is built, TSMC will be the exclusive supplier for that client for the subsequent 5 years. The company is considering one of two plant designs. The first is to build a 300 mm GIGAFABs wafer plant, which will cost NT$40 million to build (NT$ stands for New Taiwan dollar). The second is a 200 mm wafer plant, which will cost NT$30 million to build. The 300 mm GIGAFABs facility allows for the production of the most current state-of-the-art wafers, which are then used for the production of semiconductors. The company estimates that its client will order NT$15 million of product per year if the 300 mm GIGAFABs facility is built, but if the 200 mm wafer plant is built, TSMC expects to sell NT$10 million worth of product annually to its client. The company has enough resources to build either type of plant, and in the absence of risk differences, accepts the project with the highest NPV. The cost of capital is 12%.

a. Find the NPV for each project. Are the projects acceptable?

b. Find the breakeven cash inflow for each project.

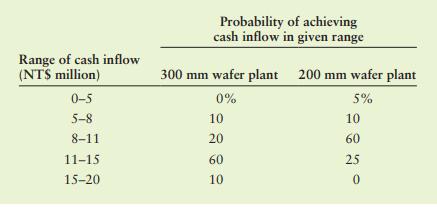

c. The company has estimated the probabilities of achieving various ranges of cash inflows for the two projects as shown in the following table. What is the probability that each project will achieve at least the breakeven cash inflow found in part b?

d. Which project is more risky? Which project has the potentially higher NPV?

Discuss the risk-return tradeoffs of the two projects.

e. If TSMC wants to minimize losses (i.e., NPV

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart