The following data are available on Volkswagen AG as of December 22, 2017: The firms board is

Question:

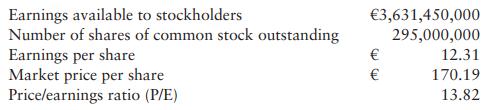

The following data are available on Volkswagen AG as of December 22, 2017:

The firm’s board is currently considering whether it should use €295,000,000 of its earnings to pay cash dividends of €1 per share or to repurchase stock at €170.20 per share.

a. Calculate the approximate number of shares the firm can repurchase at the €170.20 per share price, using the funds that would have gone to pay the cash dividend.

b. What is the EPS after the repurchase? Explain your calculations.

c. If the stock still sells at 13.82 times earnings, what will the market price be after the repurchase?

d. Compare the pre- and post-repurchase earnings per share.

e. Compare the stockholders’ positions under the dividend and repurchase alternatives. What are the tax implications under each alternative?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart