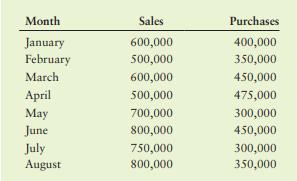

The Green PLC has projected following unit sales for January 2019 to August 2019. The sales of

Question:

The Green PLC has projected following unit sales for January 2019 to August 2019. The sales of Green PLC are 30% in cash and the remainder is on a credit for 1 month. It also expects cash receipts from its subsidiaries worth £40,000 in March, £26,000 in April, and £27,000 in June.

The firm pays 20% in cash for all its purchases. The remaining 40% is paid in the following month and the last 40% is paid 2 months later.

Wages and salaries amount to 25% of the sales in the preceding month. They also need to pay rent of £15,000 every month. The payment for a new machinery will be due in March for £45,000 and will be paid in cash. They have to pay interim tax of £45,000 in May.

The firm also expects to pay dividend of £26,000 in March and receive a cash subsidy of £37,000 from government in June.

a. Assuming that the firm has a cash balance of £32,000 at the beginning of January, estimate the end-of-month closing cash balances for each month, March to August.

b. The directors decide that the cash balance should be maintained at £20,000 at any given point of time. Determine the required total financing or excess cash balance for each month, March to August.

c. Do you think that the Green PLC will need an overdraft facility for the period from March to August? What overdraft limit should they ask for while requesting a line of credit from banks?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart