Lake Country Ltd. (LCL) is a Canadian manufacturer of outdoor furniture products. LCL manufactures high-quality, durable, and

Question:

Lake Country Ltd. (LCL) is a Canadian manufacturer of outdoor furniture products. LCL manufactures high-quality, durable, and attractive furniture such as outdoor seating, tables, and accessories. LCL sells its products directly to retailers, who in turn sell the product to the end customers.

LCL is currently owned by a small group of Canadian investors. However, for the past few years, LCL has been getting ready to take the company public. In particular, they have been trying to ensure that they have a strong set of financial statements. The company has been aggressively trying to demonstrate revenue growth and improve their bottom line, as they know that there is a lot of scrutiny when companies go public.

You currently work in the accounting department of LCL, reporting directly to the controller. The company has a 31 October year-end and is currently preparing for its annual financial statement audit. The controller has asked that you prepare the preliminary analysis of some new contracts the company entered into during the year.

Additionally, the controller has provided you with some sales information he pulled from the company’s accounting information system. He has asked you to review the information and share any insights you have.

ShopZify

LCL spent a considerable amount of money trying to win a supply contract with a large retailer, ShopZify. A total of $53,000 was spent on the following:

. $18,000: Costs incurred, mostly travel, food, and hotel costs when delivering the proposed contract to the retailer

. $20,000: Legal costs incurred on the proposal

. $15,000: Total sales commission paid to management for securing the contract

The money was considered well spent, as a contract was secured with ShopZify in April. Management estimates that the total contract will be worth over $5 million to LCL for their five-year contract period.

The ShopZify contract specifies that in a year in which total sales exceed $800,000, they will receive a 10% discount, retroactive to the beginning of the contract year. The contract period for this year began in May. The following revenue has been recorded to date:

Month Total Sales

May $45,900

June $53,100

July $122,380

August $135,060

Based on discussions with Shopzify’s management, monthly sales are projected to remain at these levels.

Outdoor Paradise

During the year LCL spent a lot of time networking with large and small retail store owners in hopes they could get their furniture into more stores and grow their revenue. A new retail store, Outdoor Paradise, was heading to a trade show and asked if they could take the pieces with them. Knowing the number of people at those shows, LCL thought it would be beneficial to both businesses. Outdoor Paradise advised that they would pay LCL for the goods once they sold. Since LCL was trying to develop a good relationship with this new retailer, LCL accepted the conditions on the basis of their verbal agreement. Given the gesture, LCL is now in the process of drafting a long-term contract with Outdoor Paradise. LCL recognized revenue for the furniture when it was delivered to Outdoor (as this is consistent with their standard revenue policies).

Sales metrics

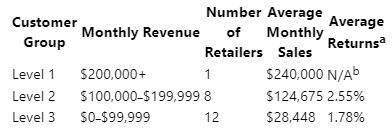

As part of their expansion project last year, the company performed a major update on its accounting information systems. The new system tracks all information (Sales/Receipts, Payments/Expenses, Payroll, Capital Assets, etc.) for the company. The system prepares exceptional reports. The company’s auditors reviewed the system and its controls earlier in the year and found it to be operating effectively. The following sales report was provided to you relating to the sales for LCL during the year:

LCL has a 45-day return period. As part of the controls, the system requires at least 6 months’ data to provide certain metrics.

Required:

Prepare the analysis of the new contracts at LCL and your analysis of the sales report provided.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260881233

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel