The financial press has been, and continues to be, replete with references to legal liability casesand to

Question:

The financial press has been, and continues to be, replete with references to legal liability cases—and to wildly excessive monetary judgments—against public accounting firms under both common law and federal securities law. Coincident with these cases, over 300 professional service firms, trade associations, accountants and corporations formed the Coalition to Eliminate Abusive Securities Suits (CEASS) that sought and won The Private Securities Litigation Reform Act of 1995, which adopted proportionate liability to replace joint-and-several liability, adopted a modified loser-pays-thewinner's-

court-costs provision, and eliminated the payment of bounties to professional plaintiffs in class action suits.

Required: Using recent articles from the business and accounting press (e.g.. The Wall Street Journal, The New York Times, Accounting Today), or an automated newspaper research service like NEXIS, INFOBANK, or ABI/ INFORM:

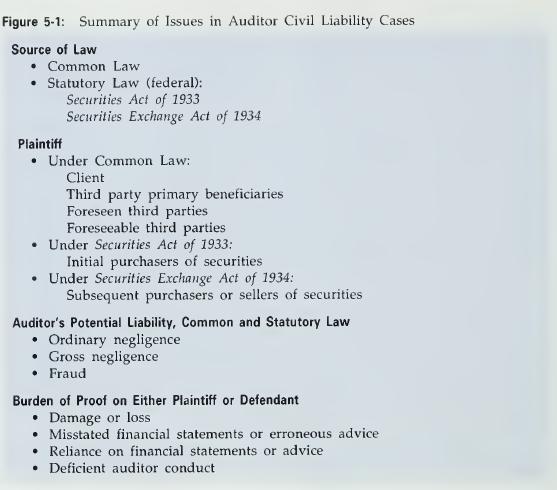

1. Select an article (or, preferably, a series of articles) related to litigation against a public accounting firm and outline the case according to the summary of issues appearing in Figure 5-1 and discussed in the chapter:

a. What is the source of law?

b. Who is the plaintiff?

c. What is the auditor's potential liability?

d. Who has the burden of proving what?

2. Would the outcome of the case likely have been any different had The Private Securities Litigation Reform Act of 1995 applied to your case?

Step by Step Answer: