You have been assigned to the audit of the F&S Savings and Loan Association. In preparing for

Question:

You have been assigned to the audit of the F&S Savings and Loan Association. In preparing for the audit, you learn the following about F&S:

Total assets approximate \($400\) million. F&S has a main office downtown, and 13 branch offices throughout the city. Four hundred people are employed by F&S, with a total payroll of \($6\) million.

F&S derives revenue from two principle sources, the major source being interest and fee income from loans. According to its articles of incorporation, F&S is restricted to making loans only to consumers for purposes such as home mortgages, auto loans, and other personal loans; that is, it cannot make loans to commercial enterprises.

The second revenue source is income from investments. F&S invests funds in short-term instruments, such as government securities and certificates of deposit, in order to have a ready source of available funds. Interest earned on investments may or may not be material to earnings, depending on the amount of funds invested during a period.

F&S has two major expenses: administrative costs, such as payroll, building maintenance, utilities, and taxes, and interest paid to depositors. The dollar magnitude of these interest payments varies considerably, depending on current market rates of interest.

Required:

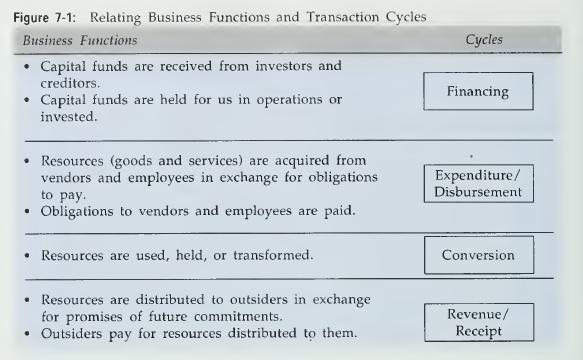

Using Figure 7-1 as a guide, identify the major business functions and related transaction cycles for the F&S Savings and Loan Association.

Step by Step Answer: