Question: Analysis: Using BPH?s financial data, perform analytical procedures to gain an understanding of BPH. Conduct a trend analysis, common-size analysis, and ratio analysis. Based on

Analysis: Using BPH?s financial data, perform analytical procedures to gain an understanding of BPH. Conduct a trend analysis, common-size analysis, and ratio analysis. Based on your analysis, document in a memo your understanding of the client, potential problem areas (accounts at risk of material misstatement), and any other special concerns.

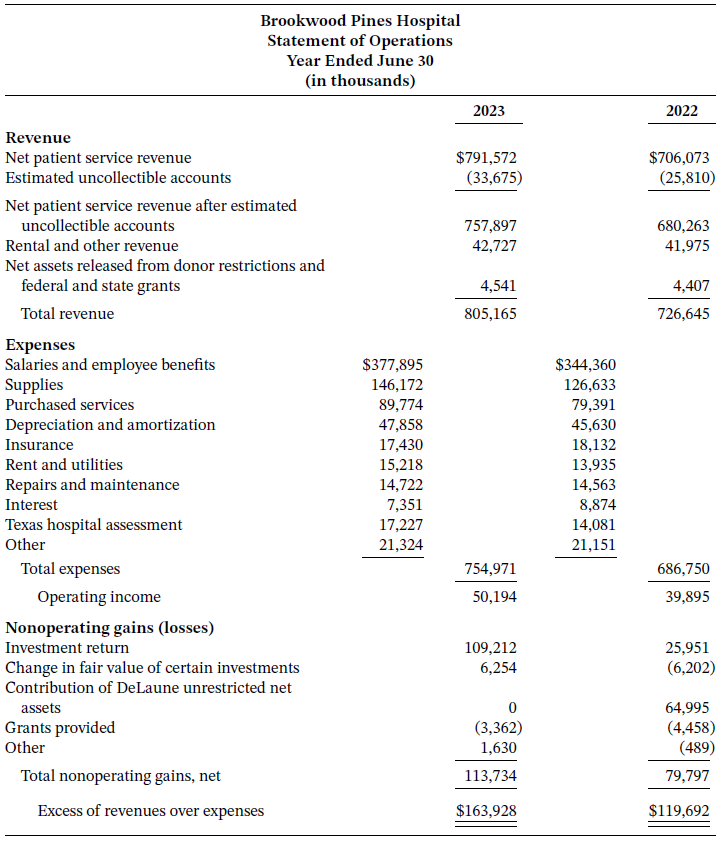

Goodfellow & Perkins LLP is a successful mid-tier accounting firm with a large range of clients across Texas. During 2022, Goodfellow & Perkins gained a new client, Brookwood Pines Hospital (BPH), a private, not-for-profit hospital. The fiscal year-end for BPH is June 30. Goodfellow & Perkins is performing the audit for the fiscal year-end June 30, 2023.

BPH provides medically necessary care to patients, regardless of their ability to pay. Both uninsured and underinsured patients are offered discounts of up to 100% of charges based on their income as a percentage of the federal poverty-level guidelines. BPH does not pursue collection of these accounts; therefore, they are not reported in patient service revenue and accounts receivable. The cost of providing the charity care is included in operating expenses.

BPH?s investments consist of mutual funds, common equities, corporate and U.S. government debt issues, state and municipal government debt issues, and trusts. A majority of the investments are the result of charitable contributions to the hospital by generous donors. Earnings from the investments are used to cover the costs of the charity care. BPH is also eligible for certain government grants to help cover the costs of the charity care.

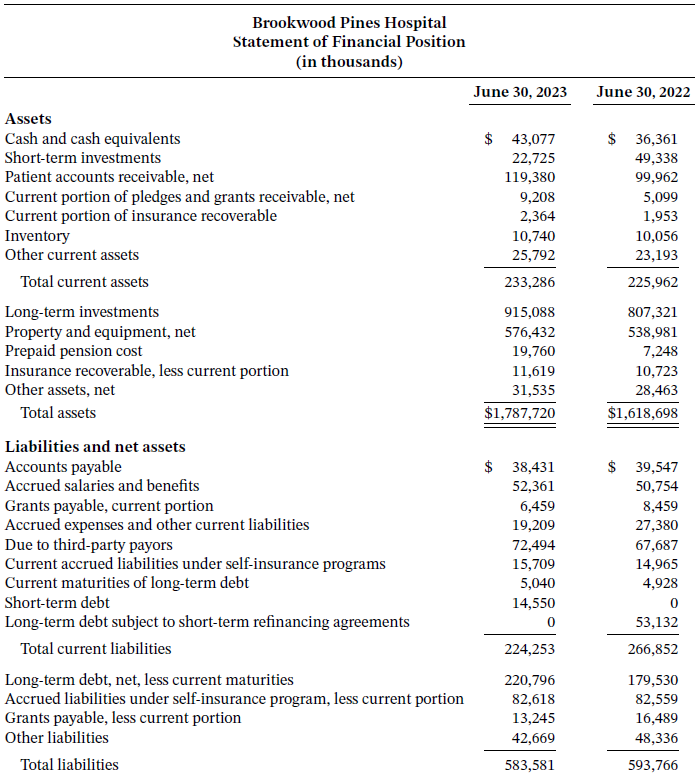

Selected financial statements and other financial information are provided below. Since BPH operates as a non-for-profit, it reports assets, liabilities, and net assets. (Note: Net assets takes the place of equity since there are no owners.)

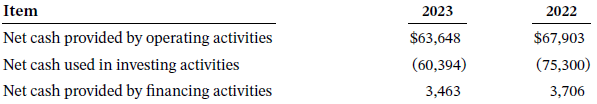

Selected information from the cash flow statement is as follows (in thousands):

Brookwood Pines Hospital Statement of Financial Position (in thousands) June 30, 2022 June 30, 2023 Assets $ 43,077 $ 36,361 Cash and cash equivalents Short-term investments 49,338 22,725 Patient accounts receivable, net Current portion of pledges and grants receivable, net Current portion of insurance recoverable Inventory Other current assets 99,962 119,380 9,208 5,099 2,364 1,953 10,740 10,056 25,792 23,193 Total current assets 233,286 225,962 Long-term investments Property and equipment, net Prepaid pension cost Insurance recoverable, less current portion Other assets, net 915,088 807,321 576,432 538,981 19,760 7,248 11,619 10,723 28,463 31,535 Total assets $1,787,720 $1,618,698 Liabilities and net assets Accounts payable Accrued salaries and benefits $ 38,431 $ 39,547 52,361 50,754 Grants payable, current portion Accrued expenses and other current liabilities Due to third-party payors Current accrued liabilities under self-insurance programs Current maturities of long-term debt 6,459 8,459 19,209 27,380 72,494 67,687 15,709 14,965 5,040 4,928 Short-term debt 14,550 Long-term debt subject to short-term refinancing agreements 53,132 Total current liabilities 224,253 266,852 Long-term debt, net, less current maturities Accrued liabilities under self-insurance program, less current portion Grants payable, less current portion 179,530 220,796 82,618 82,559 13,245 16,489 Other liabilities 42,669 48,336 Total liabilities 583,581 593,766 June 30, 2023 June 30, 2022 Net assets: Without donor restrictions With donor restrictions Total net assets Total liabilities and net assets 962,652 1,138,140 65,999 62,280 1,024,932 $1,618,698 1,204,139 $1,787,720

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

See BPH Excel spreadsheet for the trend analysis commonsize analysis and ratiosContent in the student memos will vary Students should recognize how hospitals are different from a manufacturer or retai... View full answer

Get step-by-step solutions from verified subject matter experts