Clifford Hotte had a problem. His company had come up short of its earnings target. For the

Question:

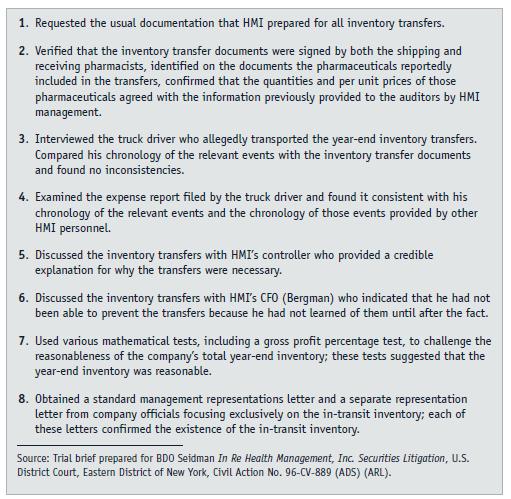

Clifford Hotte had a problem. His company had come up short of its earnings target. For the fiscal year ended April 30, 1995, financial analysts had projected that Health Management, Inc. (HMI), a New York-based pharmaceuticals distributor, would post earnings per share of $0.74. Following the close of fiscal 1995, Drew Bergman, HMI's chief financial officer (CFO) informed Hotte, the company's founder and chief executive officer (CEO), that the actual earnings figure for fiscal 1995 would be approximately $0.54 per share. According to Bergman, Hotte refused to "take the hit," that is, the almost certain drop in HMI's stock price that would follow the announcement of the disappointing earnings.1 Instead, Hotte wanted HMI to report 1995 earnings in line with analysts' predictions.2Bergman altered HMI's accounting records to allow the company to reach its 1995 earnings target. To lower cost of sales and increase HMI's gross profit and net income, Bergman inflated the company's year-end inventory by approximately $1.8 million.Bergman also posted a few other smaller "adjustments" to HMI's accounting records.Both Bergman and Hotte realized that the company would have to take elaborate measures to conceal the accounting fraud from its audit firm. Bergman was very familiar with BDO Seidman and its audit procedures since he had been employed by that accounting firm several years earlier. In fact, Bergman had supervised BDO Seidman's 1989 and 1990 audits of HMI.HMI's inventory fraud was not particularly innovative. Corporate executives who want to embellish their company's operating results are aware that among the easiest methods of achieving that goal is overstating year-end inventory. What was unique about HMI's inventory hoax was that it triggered one of the first major tests of an important and controversial new federal law, the 1995 Private Securities Litigation Reform Act (PSLRA). The PSLRA was the only law passed by Congress during President Clinton's first administration that overcame a presidential veto.Among the parties most pleased by the passage of the PSLRA were the large, international accounting firms. These firms' mounting litigation losses in the latter decades of the twentieth century had prompted them to lobby Congress to reform the nation's civil litigation system. In particular, the firms argued that they were being unfairly victimized by the growing number of class-action lawsuits. The bulk of these lawsuits were being filed under the Securities Exchange Act of 1934, one of the federal statutes that created the regulatory infrastructure for the nation's securities markets in the early 1930s.Top officials of the major accounting firms believed that the PSLRA, which amended key provisions of the 1934 Act, would make it more difficult for plaintiff attorneys to extract large legal judgments or settlements from their firms. The jury's verdict in favor of BDO Seidman in the HMI lawsuit seemed to support that conclusion. HMI's stockholders filed suit against BDO Seidman for failing to detect the inventory fraud masterminded by Drew Bergman and Clifford Hotte. Michael Young, a prominent New York attorney who headed up BDO Seidman's legal defense team, predicted that the case would become a "watershed event" in the accounting profession's struggle to curb its litigation losses.3

Questions1. BDO Seidman's attorneys pointed out correctly that professional standards do not prohibit auditors and client personnel from being "friends." At what point do such relationships result in violations of the auditor independence rules and guidelines? Provide hypothetical examples to strengthen your answer.2. According to court testimony, on July 20, 1995, Drew Bergman recommended to HMI's board of directors that Mei-ya Tsai be hired as the company's chief accounting officer (CAO). One week later, BDO Seidman issued its audit report on HMI's 1995 financial statements. Under presently existing professional standards would this situation have presented an independence "problem" for BDO Seidman? Defend your answer.3. Under what circumstances is an inventory rollback or rollforward typically performed? How valid is the evidence yielded by this audit procedure? Explain.4. Jill Karnick abandoned her attempt to complete an inventory rollforward because of the considerable amount of work the procedure involved. Do you believe she made an appropriate decision given the circumstances she faced? How should auditors weigh the cost of an audit procedure, in terms of time and other resources, against the quantity and quality of evidence that it yields?5. Should the results of inconclusive audit tests be included in audit workpapers? Defend your answer.6. A major focus of the trial in this case was BDO Seidman's consideration of, and response to, the "red flags" apparent during the 1995 HMI audit. Define or describe the phrase "red flags." Explain the impact of red flags identified by auditors on each major phase of an audit.7. The PSLRA requires auditors to report to the SEC illegal acts "that would have a material effect" on a client's financial statements, assuming client management refuses to do so. Briefly describe three hypothetical situations involving potential illegal acts discovered by auditors. Indicate whether the auditors involved in these situations should insist that client management report the given item to the SEC. Defend your decision for each item.

Step by Step Answer: