In 1984, Scott London graduated with an accounting degree. He accepted an entry-level audit position with the

Question:

In 1984, Scott London graduated with an accounting degree. He accepted an entry-level audit position with the Los Angeles office of Peat Marwick, the U.S. predecessor of KPMG that was formed three years later. The personable and wellliked London quickly advanced up KPMG's employment hierarchy. In 1995, KPMG promoted London to partner and nine years later chose him to head up the firm's Pacific Southwest audit practice that was managed from its Los Angeles office. In the latter role, London supervised more than 500 auditors and was directly or indirectly involved in the audits of many of KPMG's largest clients. He served as the "lead audit engagement" partner for both Herbalife and Skechers USA, the footwear company.

London's responsibilities included establishing and maintaining a highly visible presence in the greater Los Angeles business community. Among other positions, London served on the Los Angeles Chamber of Commerce's board of directors and chaired the high-profile Los Angeles Sports Council. London's networking activities also included membership in an exclusive Los Angeles area country club where he became acquainted with Bryan Shaw, a local jeweler. The two men and their wives became close friends and socialized frequently. In subsequent interviews, London reported that Shaw expressed an interest in his work at KPMG and often asked him about his audit clients.

The economic recession of 2008 and 2009 had a particularly adverse impact on Shaw's retail jewelry business since it caused consumers to postpone purchases of discretionary goods such as jewelry. Sympathy for his friend's plight caused London to begin passing him valuable confidential information regarding Herbalife, Skechers, and other KPMG public company audit clients. The Securities and Exchange Commission (SEC) reported that "Shaw and London communicated about the non-public information almost exclusively using their cellular telephones" although in one instance "London disclosed non-public information in the presence of others during a golf outing."2

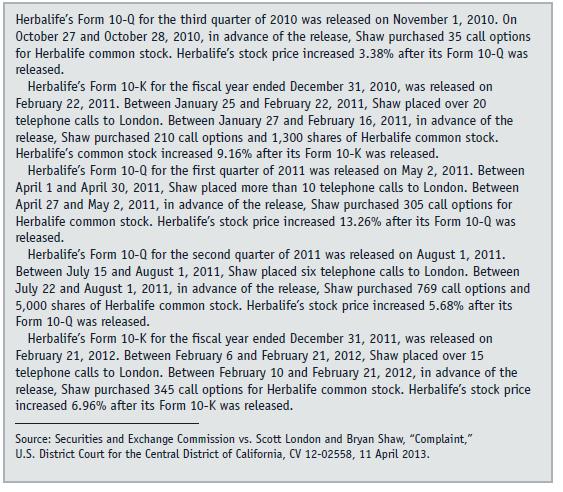

Shaw relied on the inside information obtained from Scott London to make fortuitous trades in the stocks of KPMG audit clients prior to their earnings announcements.

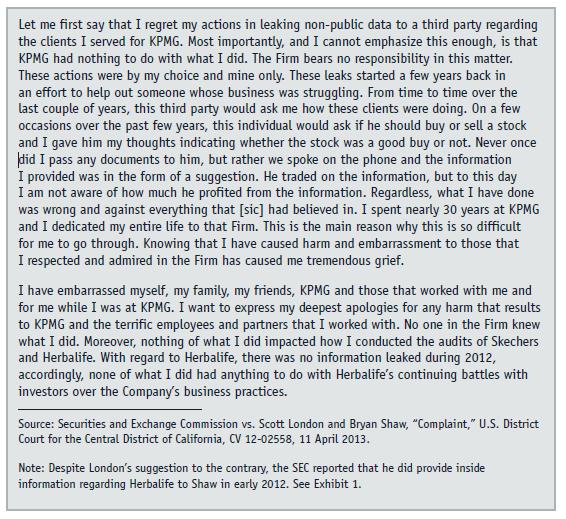

Exhibit 1 includes the SEC's descriptions of the Herbalife stock trades made by Bryan Shaw between 2010 and 2012. Shaw made each of those trades shortly before Herbalife released SEC 10-Q or 10-K filings and typically placed multiple phone calls to London in advance of the trades. The stock trades reported in Exhibit 1 along with similar stock trades made by Bryan Shaw in other KPMG audit clients netted him approximately $1.27 million in stock market profits. According to the SEC,

"London accepted cash and other valuable items, including jewelry, concert tickets, and a Rolex Daytona Cosmograph, as compensation for the inside information he provided to Shaw."3 The total value of that "compensation" exceeded $70,000.

Questions

1. Identify the specific circumstances under which auditors are allowed to provide confidential client information to third parties.

2. Does the profession’s code of ethics prohibit auditors from “discussing” their clients with family members, friends, and other acquaintances? If not, what types of client information can be shared with those parties? Defend your answer.

3. What measures could the Big Four firms take to mitigate the risk their partners will improperly share confidential client information with third parties? Would these measures be cost effective? Why or why not?

4. Consider the following individuals: Scott London, Bryan Shaw, Thomas Flanagan, James Gansman, and the wife of the Deloitte partner who eavesdropped on her husband’s conversations to obtain inside information regarding his clients. Using the scale shown below, evaluate the conduct of these individuals. Be prepared to defend your choices.

5. Suppose you and a close friend are employed by the same accounting firm. You are assigned to the firm’s audit staff, while your friend is a consultant who works on M&A engagements. What would you do under the following circumstances:

(1) your friend discloses to you highly confidential “market-moving” information regarding a soon-to-be announced merger;

(2) your friend not only discloses such information to you but also informs you that he plans to use it to make a “quick” profit in the stock market? In your responses, comment on your ethical responsibilities in each scenario.

Step by Step Answer: