Marissa just got hired at a new job for an annual salary of $112,950. After the standard

Question:

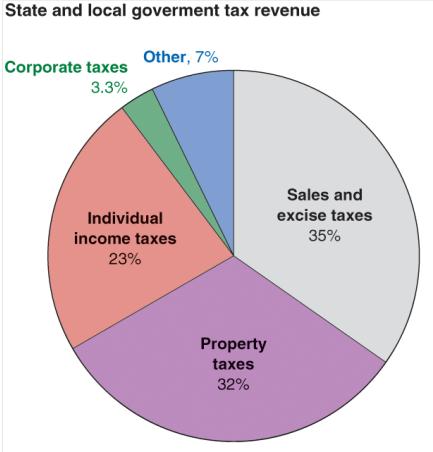

Marissa just got hired at a new job for an annual salary of $112,950. After the standard deduction, her taxable income will be $100,000. Use the marginal tax rates shown in Figure 9 to calculate how much she will owe in income taxes if she has no other income and no additional deductions. What share of her income would she be paying in taxes?

Figure 9

Transcribed Image Text:

State and local goverment tax revenue Corporate taxes 3.3% Other, 7% Individual income taxes 23% Property taxes 32% Sales and excise taxes 35%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Economics

ISBN: 9781319330156,9781319419769

2nd Edition

Authors: Betsey Stevenson, Justin Wolfers

Question Posted:

Students also viewed these Business questions

-

Matthew B. (age 42) and Shelli R. (age 48) Thomson are married and live at 7605 Walnut Street, Kansas City, MO 64114. Matthew is a chemist employed by Sargent Pharmaceuticals, Inc., and Shelli is a...

-

Explain the meaning of the terms emoluments, employments and office for the purposes of PAYE as you earn systems. 2. Explain the actual receipts basis of assessing the emoluments from the employment...

-

Summarize the extract given below? When Paul Farmer graduated from Duke University at 22, he was unsure whether he wanted to be an anthropologist or a doctor. So he went to Haiti. As a student, Paul...

-

List four common types of finite elements?

-

1. Based on the marketing activities DNBC has tried, do you think it has a production-oriented marketing or a consumer-oriented philosophy? Explain your reasoning with examples. 2. Research the City...

-

Suppose you buy a new home and finance \(90 \%\) of the price with a mortgage from a bank. Suppose that a few years later the value of your home falls below your mortgage balance and you decide to...

-

For the given loading, determine the zero-force members in the truss shown.

-

A taxpayer filing as Single has $25,600 of taxable income. Included in gross income is a 1099- INT with Box 1 interest income of $5,000 , tax-exempt interest of $3,000 , and interest on U.S. savings...

-

In an effort to encourage people to purchase electric cars, the federal government passes a tax credit of $2,500 for each new electric car that is bought in the United States. Who do you think will...

-

Spending on Medicare and Social Security is expected to grow over the next few decades as the share of the population who are elderly grows. Explain why an aging population increases government...

-

Describe the nature of learning and memory?

-

Country A has export sales of $100 billion, government purchases of $400 billion, business investment of $250 billion, imports of $125 billion, and consumption spending of $1,550 billion. Use the...

-

The incentive to consume tax-deductible goods, instead of nondeductible goods, increases when

-

Canada's initial immigration policies after World War II under Prime Minister King's leadership were not good for the country in terms of human rights, denying certain immigrants from entering Canada...

-

2. The median household incomes in Virginia from 2013 and 2017 are listed in the table below. (Source: "Virginia Household Income." Department of Numbers,...

-

Assume the demand curve The 5-year breakeven inflation rate has fallen from 2.7% in March to 2.3% in September 2023. Everything else being equal, how would the demand curve and/or supply curve for...

-

State which court(s) have jurisdiction as to each of these lawsuits: (a) Pat wants to sue his next-door neighbor Dorothy, claiming that Dorothy promised to sell him the house next door. (b) Paula,...

-

The Alert Company is a closely held investment-services group that has been very successful over the past five years, consistently providing most members of the top management group with 50% bonuses....

-

Explain how higher saving leads to a higher standard of living. What might deter a policymaker from trying to raise the rate of saving?

-

Does a higher rate of saving lead to higher growth temporarily or indefinitely?

-

Why would removing a trade restriction, such as a tariff, lead to more rapid economic growth?

-

A contract between an insurance company and an individual for which the individual pays a premium in exchange for coverage of specified motor vehicle-related financial losses is called Blank______....

-

To practice in AuUnder the Framework a 'material' item must be: a. unusual b. likely to influence the decisions of users c. Large d. all of the abovestralia, an accountant: a. must be registered by...

-

Select any accounts that would be included on the Income Statement of a company (scroll down to see all choices): Check All That Apply DividendsDividends Accounts PayableAccounts Payable Rent...

Study smarter with the SolutionInn App