For the past several years, large food manufacturers followed Kraft-Heinz's lead by aggressively slashing costs to improve

Question:

For the past several years, large food manufacturers followed Kraft-Heinz's lead by aggressively slashing costs to improve profitability. This cost cutting did not work well for Kraft-Heinz or for other manufacturers such as General Mills, marketer of Yoplait yogurt, Cheerios and other breakfast cereals, Häagen Dazs ice cream, and dozens of other popular brands. Rather, cost cutting hurt the quality of well-known brands. General Mills took a different tack, raising prices 20 percent and maintaining product quality and brand reputation. By one metric, this has not worked out well for General Mills. Sales volume decreased in the first quarter following the price hikes. However, the company's margins improved, making it more profitable than before the price increase. Companies realize that sales volumes will decrease after price hikes. But they also know that they can maintain or even enhance profitability despite a decrease in sales.

Assuming a contribution margin of 20 percent and sales of $5 billion, with a 20 percent price increase, by how much can sales decrease before profitability (total contribution) drops below its current level? Refer to Financial Analysis of Marketing Tactics: Price Decrease in Appendix 2: Marketing by the Numbers to learn how to perform this analysis, but determine the maximum drop in sales before total contribution is negatively affected.

Data from appendix 2

Wise Domotics is also considering lowering its price to increase sales revenue through increased volume. The company’s research has shown that demand for most types of consumer electronics products is elastic—that is, the percentage increase in the quantity demanded

is greater than the percentage decrease in price.

What increase in sales would be necessary to break even on a 10 percent decrease in price? That is, what increase in sales will be needed to maintain the total contribution that Wise Domotics realized at the higher price? The current total contribution can be determined by multiplying the contribution margin by total sales:

![]()

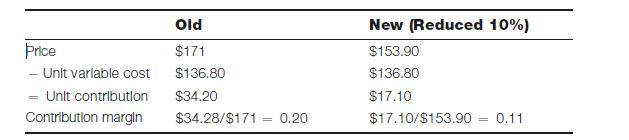

Price changes result in changes in unit contribution and contribution margin. Recall that the contribution margin of 20 percent was based on variable costs representing 80 percent of sales. Therefore, unit variable costs can be determined by multiplying the original price by this percentage: $171 × 0.80 = 136.80 per unit. If price is decreased by 10 percent, the new price is $153.90. However, variable costs do not change just because price decreased, so the contribution and contribution margin decrease as follows:

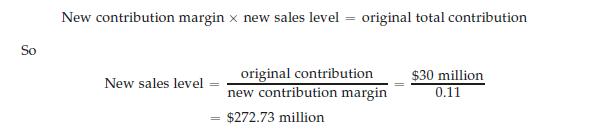

So a 10 percent reduction in price results in a decrease in the contribution margin from 20 percent to 11 percent. To determine the sales level needed to break even on this price reduction, we calculate the level of sales that must be attained at the new contribution margin to achieve the original total contribution of $30 million:

Thus, sales must increase by almost $123 million ($273 million − $150 million) just to break even on a 10 percent price reduction. This means that Wise Domotics must increase market share to 10 percent ($273 million/$2.5 billion) to achieve the current level of profits (assuming no increase in the total market sales). The marketing manager must assess whether or not this is a reasonable goal.

Step by Step Answer: