Corporations are required to detail their book/tax differences on either Schedule M-1 or Schedule M-3 attached to

Question:

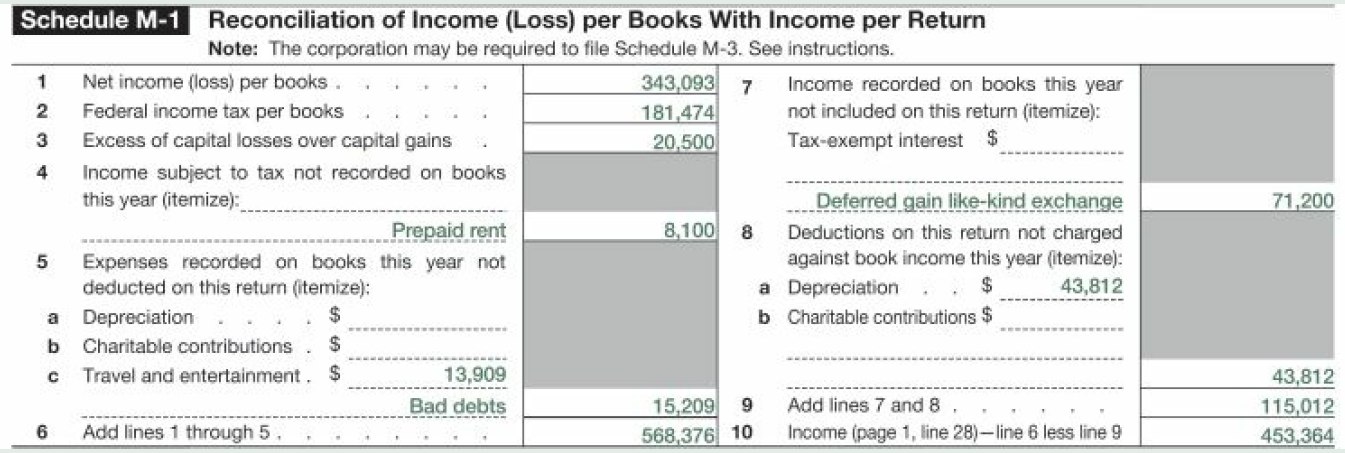

Schedule M-1

Transcribed Image Text:

Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See instructions. Net income (loss) per books . Federal income tax per books Excess of capital losses over capital gains 343,093 7 181,474 Income recorded on books this year not included on this return (itemize): Tax-exempt interest 2. 20,500 Income subject to tax not recorded on books this year (itemize): Deferred gain like-kind exchange Deductions on this return not charged against book income this year (itemize): 71,200 8,100 Prepaid rent Expenses recorded on books this year not deducted on this return (itemize): Depreciation Charitable contributions . Travel and entertainment. $ 2$ 43,812 a Depreciation b Charitable contributions $ 2$ a 13,909 43,812 115,012 453,364 Add lines 7 and 8 Income (page 1, line 28)-line 6 less line 9 15,209 Bad debts Add lines 1 through 5. 568,376 10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 44% (9 reviews)

For many corporations book income has been reviewed or audi...View the full answer

Answered By

Lawrence Okyere

My professional qualities are a strong communicator, a good listener, a good collaborator, I'm adaptable, I'm engaging, and I've patient and empathy.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted:

Students also viewed these Business questions

-

You have recently been hired by Goff Computer, Inc. (GCI), in the finance area. GCI was founded eight years ago by Chris Goff and currently operates 74 stores in the Southeast. GCI is privately owned...

-

Publicly traded corporations are required to have their financial statements audited by an independent auditor. The Canadian Securities Administrators National Instrument 52-109 Certification of...

-

You have recently been hired by Layton Motors, Inc. (LMI), in its relatively new treasury management department. LMI was founded eight years ago by Rachel Layton. Rachel found a method to manufacture...

-

Calculate the dollar proceeds from the FIs loan portfolio at the end of the year, the return on the FIs loan portfolio, and the net interest margin for the FI if the spot foreign exchange rate has...

-

KPMG Azsa ultimately agreed to accept Olympus's accounting decisions for the Gyrus acquisition after being given an "experts" report that supported those decisions. In the United States, what...

-

Is this strategically something that Grainger should do? What have they not considered that may be important?

-

The composite post in Figure 1.49 has the same properties and dimensions as in Problem 1.13, except that there is a gap = 0.1 mm between the top of thecover plate on the post and the upper support....

-

A company retired $60 million of its 6% bonds at 102 ($61.2 million) before their scheduled maturity. At the time, the bonds had a remaining discount of $2 million. Prepare the journal entry to...

-

Using activity-based costing, compute the overhead cost per unit for each model. (Round "Activity Rate" to 2 decim other answers to the nearest whole dollar amount.) Overhead cost per unit-Model X...

-

Belinda is a 17 year old college student. She enters into a written contract with Steve, an adult, for the purchase of Steve's 1964 Corvette for $2,000. The performance of the contract will occur in...

-

Corporations are allowed a dividends-received deduction for dividends from other domestic, taxable corporations. How does this deduction prevent the same corporate income from potentially three...

-

In your own words, explain why a tax credit is more valuable than a tax deduction of the same dollar amount.

-

To help you understand and compare the performance of two companies in the same industry. Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Financial Statements...

-

In this exercise, we examine the effect of the interconnection network topology on the CPI of programs running on a 64-processor distributed-memory multiprocessor. The processor clock rate is 2.0...

-

Sequential consistency (SC) requires that all reads and writes appear to have executed in some total order. This may require the processor to stall in certain cases before committing a read or write...

-

It is critical that the scoreboard be able to distinguish RAW and WAR hazards, because a WAR hazard requires stalling the instruction doing the writing until the instruction reading an operand...

-

You are building a system around a processor with in-order execution that runs at 1.1 GHz and has a CPI of 1.35 excluding memory accesses. The only instructions that read or write data from memory...

-

Find three run-time errors in the following program. public class Has Errors { } public static void main(String[] args) { } int x = 0; int y = 0; Scanner in new Scanner("System.in");...

-

Studies conducted in New York City and Boston have noticed that more heart attacks occur in December and January than in all other months. Some people have tried to conclude that holiday stress and...

-

Evaluate each logarithm to four decimal places. log 0.257

-

Mr. and Mrs. Ahern pay $18,000 annual tuition to a private school for their three children. They also pay $2,300 property tax on their personal residence to support the local public school system....

-

This year, Lexon Company built a light industrial facility in County G. The assessed property tax value of the facility is $20 million. To convince Lexon to locate within its jurisdiction, the county...

-

Churchill University is located in a small town that depends on real property taxes for revenue. Over the past decade, the university has expanded by purchasing a number of pcommercial buildings and...

-

Diaz Company issued $91,000 face value of bonds on January 1, Year 1. The bonds had a 9 percent stated rate of interest and a ten- year term. Interest is paid in cash annually, beginning December 31,...

-

Manvir had to make payments of $1,125 every 6 months to settle a $22,000 loan that he received at 4.52% compounded semi-annually. a. How long did it take to settle the loan?

-

If I invest a single amount of $14,000 in an account earning 8% p.a. compounding quarterly for 5 years, how much interest will I have earned in those 5 years?

Study smarter with the SolutionInn App