Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a

Question:

Before-tax net income from sales:

Domestic sales ........................................................ $ 967,900

UK sales (foreign source income) ......................... 415,000

$1,382,900

Dividend income:

Brio Inc. .................................................................. $ 8,400

French Dollin (foreign source income) ............... 33,800

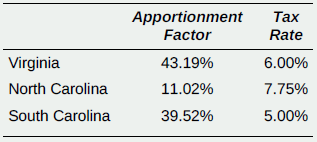

- Dollin pays state income tax in Virginia, North Carolina, and South Carolina. All three states tax their apportioned share of Dollin€™s net income from worldwide sales. Because Virginia is Dollin€™s commercial domicile, it also taxes Dollin€™s U.S. source (but not foreign source) dividend income net of any federal dividends received deduction. The states have the following apportionment factors and tax rates.

- Dollin paid $149,200 income tax to the United Kingdom.

- Dollin elects to claim the foreign tax credit rather than to deduct foreign income taxes.

Brio Inc. is a taxable U.S. corporation. Dollin owns 2.8 percent of Brio€™s stock.

- Dollin has owned 100 percent of the stock of French Dollin for 10 years. None of French Dollin€™s earnings are considered GILTI or sub part F income.

- Earnings of the UK branch are not considered FDII.

Solely on the basis of these facts, compute the following:

a. Dollin€™s state income tax for Virginia, North Carolina, and South Carolina.

b. Dollin€™s federal income tax. Assume that Dollin paid the state taxes during the year, and no state income tax is allocable to foreign source income.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan