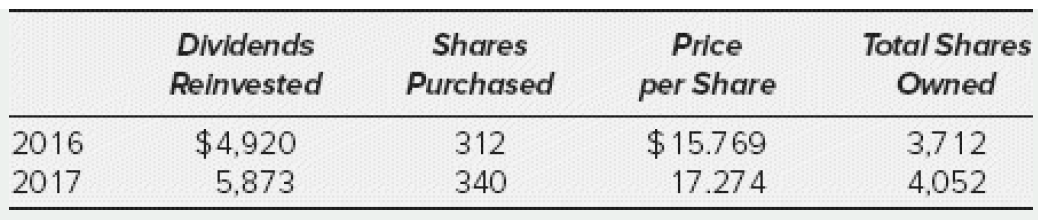

In 2016, Mr. Dale paid $47,600 for 3,400 shares of GKL Mutual Fund and elected to reinvest

Question:

a. If Mr. Dale sells his 4,052 shares for $18 per share, compute his recognized gain.

b. If he sells only 800 shares for $18 per share and uses the FIFO method to determine basis, compute his recognized gain.

c. If he sells only 800 shares for $18 per share and uses the average basis method, compute his recognized gain.

Assume the taxable year is 2018.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2019 Edition

ISBN: 9781260161472

22nd Edition

Authors: Sally Jones, Shelley C. Rhoades Catanach, Sandra R Callaghan

Question Posted: