Zeno Inc. sold two capital assets in 2016. The first sale resulted in a $53,000 capital loss,

Question:

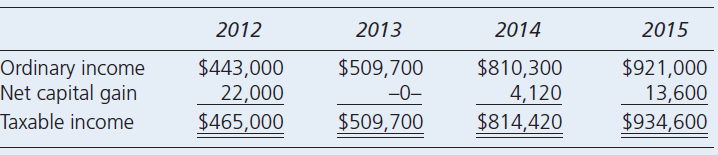

Zeno Inc. sold two capital assets in 2016. The first sale resulted in a $53,000 capital loss, and the second sale resulted in a $25,600 capital gain. Zeno was incorporated in 2012, and its tax records provide the following information:

a. Using a 34 percent tax rate, compute Zeno’s tax refund from the carryback of its 2016 nondeductible capital loss.

b. Compute Zeno’s capital loss carryforward into 2017.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2017

ISBN: 9781259753015

20th Edition

Authors: Sally M. Jones, Shelley C. Rhoades Catanach, Sandra R. Callaghan

Question Posted: