Question: Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are

Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $300,000 in Year 1 and $40,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $120,000 each year in Years 2, 3, and 4. Use a 7 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the Companion website to calculate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis.

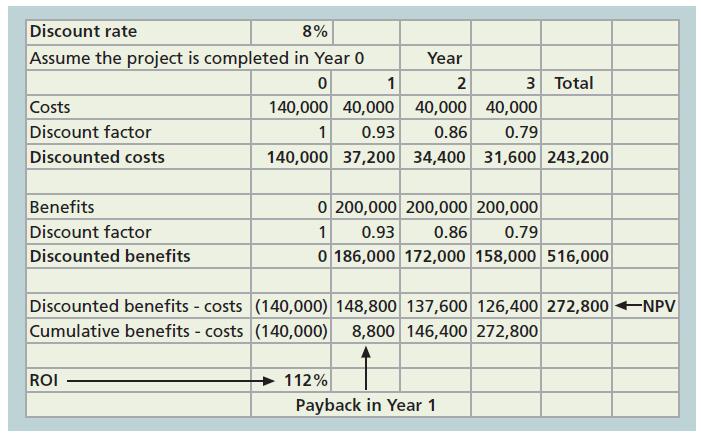

Data from in Figure 4-5

Discount rate 8% Assume the project is completed in Year 0 0 Costs Discount factor Discounted costs Benefits Discount factor Discounted benefits Discounted benefits - costs Cumulative benefits - costs ROI 1 140,000 40,000 1 0.93 140,000 37,200 Year 2 40,000 40,000 0.86 0.79 34,400 31,600 243,200 3 Total 0 200,000 200,000 200,000 1 0.93 0.86 0.79 0 186,000 172,000 158,000 516,000 (140,000) 148,800 137,600 126,400 272,800 NPV (140,000) 8,800 146,400 272,800 112% Payback in Year 1

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

To perform the financial analysis for the given project we will organize our data similarly to the provided format and calculate the Net Present Value ... View full answer

Get step-by-step solutions from verified subject matter experts