Question: 25. Bishop Corporation uses normal process costing (weighted average method), and applies manufacturing overhead at a rate of 60% of direct labor costs. Bishop has

25. Bishop Corporation uses normal process costing (weighted average method), and applies manufacturing overhead at a rate of 60% of direct labor costs. Bishop has two departments, Molding and Assembly (beginning work-in-process balance = $50,000 in Molding and $60,000 in Assembly). Altogether, Bishop purchased $500,000 in materials on account last period,

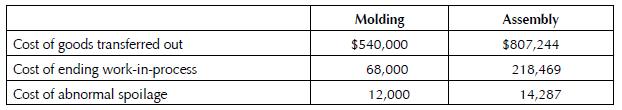

$100,000 of which was not traceable to products. In addition to those indirect materials, Bishop spent $50,000 cash on variable manufacturing overhead, $75,000 cash on fixed overhead, and recognized $20,000 in equipment depreciation. Bishop accrued $200,000 in direct labor costs in Molding, and $150,000 in direct labor costs in Assembly. Bishop used $250,000 worth of direct materials in Molding, $200,000 worth of direct materials in Assembly, and $80,000 in indirect materials. The process costing report at the end of the period was as follows:

\Beginning raw materials inventory was $75,000, and beginning finished goods inventory was $150,000. Bishop sold goods costing $800,000. Bishop spent $210,000 cash on period expenses.

\Beginning raw materials inventory was $75,000, and beginning finished goods inventory was $150,000. Bishop sold goods costing $800,000. Bishop spent $210,000 cash on period expenses.

Make all journal entries for the period, and post them to t-accounts.

Molding Assembly Cost of goods transferred out $540,000 $807,244 Cost of ending work-in-process 68,000 218,469 Cost of abnormal spoilage 12,000 14,287

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts