Continuing with the BankCorp example, you focus now on BankCorps cost structure. One model, a simple linear

Question:

Continuing with the BankCorp example, you focus now on BankCorp’s cost structure. One model, a simple linear regression model, you are researching for BankCorp’s operating costs is

Ŷ = a + bX, where Ŷ is a forecast of operating costs in millions of US dollars and X is the number of branch offices; and Yˆ represents the expected value of Y given X, or E(Y | X). You interpret the intercept a as fixed costs and b as variable costs. You estimate the equation as follows:

Ŷ = 125+0.65X.

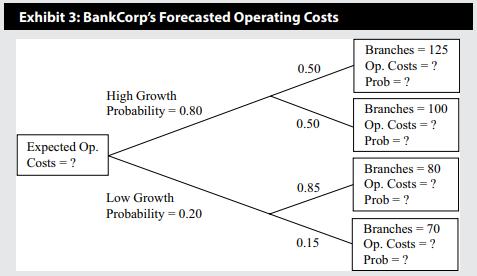

BankCorp currently has 66 branch offices, and the equation estimates operating costs as 12.5 + 0.65(66) = USD55.4 million. You have two scenarios for growth, pictured in the tree diagram in Exhibit 3.

1. Compute the forecasted operating costs given the different levels of operating costs, using Ŷ = 12.5 + 0.65X. State the probability of each level of the number of branch offices. These are the answers to the questions in the terminal boxes of the tree diagram.

2. Compute the expected value of operating costs under the high growth scenario. Also calculate the expected value of operating costs under the low growth scenario.

3. Refer to the question in the initial box of the tree: What are BankCorp’s expected operating costs?

Step by Step Answer: