In 1991 the federal government imposed a 10% luxury tax on sales of new recreational boats and

Question:

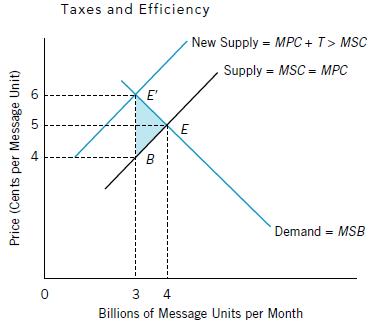

In 1991 the federal government imposed a 10% “luxury tax” on sales of new recreational boats and on certain other high-priced consumer goods. Sales of new recreational boats plummeted, causing unemployment among boat building workers. In 1996, this federal tax was repealed. What would have been the equity based justification for this “luxury tax.” Draw a diagram similar to Figure 2.3. Design your diagram to show the luxury tax incidence spread evenly between the consumer and the producer. Also show a 50% drop in boat sales, after the imposition of the luxury tax. Did the luxury tax yield the equity outcome initially expected? Why?

Figure 2.3

Step by Step Answer:

Related Book For

Public Finance A Contemporary Application Of Theory To Policy

ISBN: 9780538754460

10th Edition

Authors: David N Hyman

Question Posted: