Which of the following should Liu conclude from the results shown in Exhibit 2? A. The average

Question:

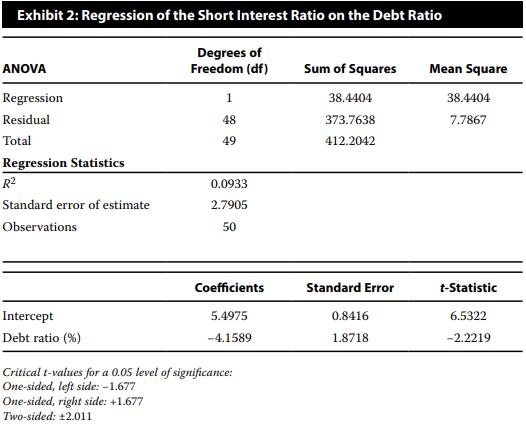

Which of the following should Liu conclude from the results shown in Exhibit 2?

A. The average short interest ratio is 5.4975.

B. The estimated slope coefficient is different from zero at the 0.05 level of significance.

C. The debt ratio explains 30.54 percent of the variation in the short interest ratio.

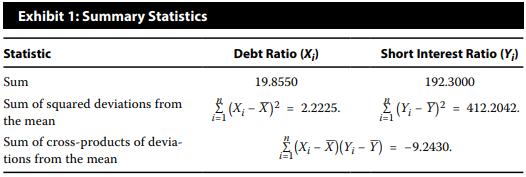

Anh Liu is an analyst researching whether a company’s debt burden affects investors’ decision to short the company’s stock. She calculates the short interest ratio (the ratio of short interest to average daily share volume, expressed in days) for 50 companies as of the end of the year and compares this ratio with the companies’ debt ratio (the ratio of total liabilities to total assets, expressed in decimal form). Liu provides a number of statistics in Exhibit 1. She also estimates a simple regression to investigate the effect of the debt ratio on a company’s short interest ratio. The results of this simple regression, including the analysis of variance (ANOVA), are shown in Exhibit 2. In addition to estimating a regression equation, Liu graphs the 50 observations using a scatter plot, with the short interest ratio on the vertical axis and the debt ratio on the horizontal axis.

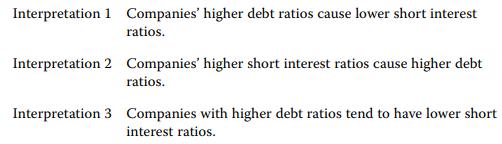

Liu is considering three interpretations of these results for her report on the relationship between debt ratios and short interest ratios:

She is especially interested in using her estimation results to predict the short interest ratio for MQD Corporation, which has a debt ratio of 0.40.

Step by Step Answer: