1. Read the Case: What is the company worth? Grant explains to the management team that the...

Question:

1. Read the Case: What is the company worth?

Grant explains to the management team that the company valuation is critical from both investors and the company. The goal is to produce a rough estimated value for New Tech?s common shares. He and Elizabeth have prepared documents that can be used to put a price tag on New Tech?s market data.

Valuation: the company?s perspective

Grant points out the importance of having a solid understanding of New Tech?s value. Of they do not know the company?s worth, they will not know how much ownership they have to give up in exchange for the investment they need. If the company is worth $2 million, then a $1 million investment represents a big piece of the business-and a large percentage of the equity. On the other hand, if the business is worth $10 million, then an investment of $1 million represents a much smaller proportion if the business?s equity. The other benefit of determining New Tech?s value is that it will provide management with a clearer understanding of how investors will evaluate New Tech as an investment opportunity.

DCF Method

Grant points out that they should use the discounted free cash flow technique for valuing New Tech, and, though he is aware of other methods, he feels that the discounted free cash flow approach is the most appropriate. Grant explains to the members of the management team the various steps involved in the process.

Requirements:

1. Determine the present value of the free cash flows New Tech expects over the next 5 years (FCF=NOPAT-investment in net operating working capital and fixed assets)

2. Determine the company?s terminal value at the end of the 5 years and what that amount is worth today. To calculate the terminal value, assume a 8% growth rate of the free cash flows in perpetuity.

3. Calculate New Tech?s estimated market value by adding these two amounts: the present value of the free cash flows over the 5 years and the terminal value of the company at the end of the 5-year period.

2. Grant has determined that the appropriate risk-adjusted discount rate is 20%. Grant subjectively determined (with input from New Tech?s management) the 20% discount rate based on estimated required rates of return, as well as economic-industry-, and company-specific risk factors.

Valuation Survey of Methods

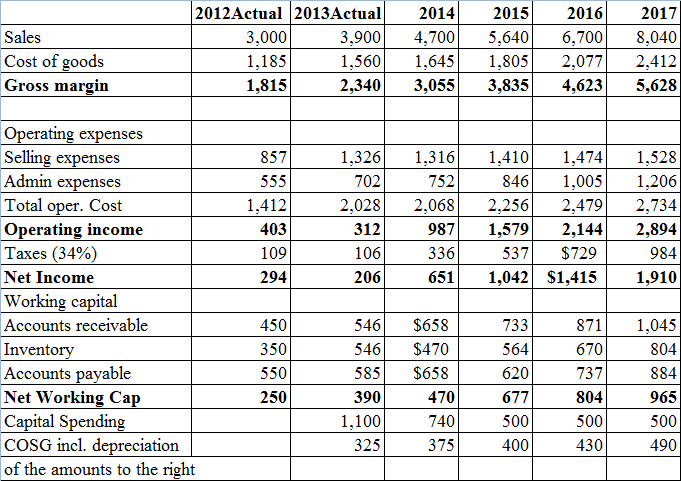

Table: New Tech?s Financial Forecast ($,000a)

To Do Calculate the value of New Tech today, using the data given and the preceding assumptions

Valuation: The Investor?s Perspective

Once Grant has established a value of the company, he discusses the investor?s perspective. Of course, investors will be looking for exceptional returns on their investment. They will also want to determine how much of the form?s shares they need to acquire to command that return.

Grant expects the early-stage investors will want to earn a return of 30% to compensate for the risk. The rate of return reflects the investor?s perception of the economic, industry-, and company-specific risk factors. It also accounts for the alternative investments available. Grant think that 30% will be adequate compensation for the risk associated with investing in a new, untried venture like New Tech?s growth plan.

Grant explains that investors will evaluate the percentage of shares they require by looking at the potential return at exit, i.e. at the end of the investment period. This exit might be achieved through an IPO, a sale of the whole company, a buyback or redemption of investor?s shares, or other means. The investor will be getting a percentage of the value if New Tech?s share at exit and will want to be sure that percentage is high enough for them to hit the rate of return target of 30%.

2. Grants initial assessment is that new tech will fall short of an expected 30% after- tax return on investment for its investors. If that is so, they will need to alter their offering somehow to accommodate investor demands, possibly the percentage of shares they will offer. But first he explains how the calculation is done.

Requirements:

Grant starts with the assumption that potential investors would likely want to exit around 2017.

1. Assuming that the investors own 30% of New Tech?s shares at the time of exit and that the 2017 value would be three times the 2017 EBITDA, what would be the value of the firm in 2017?

2. What would be the investor?s share of the 2017 value?

3. What would be the return on a $1 million investment in the company today at the same valuation?

4. Is your calculated return adequate? If not, how can it be made acceptable to investors?

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella