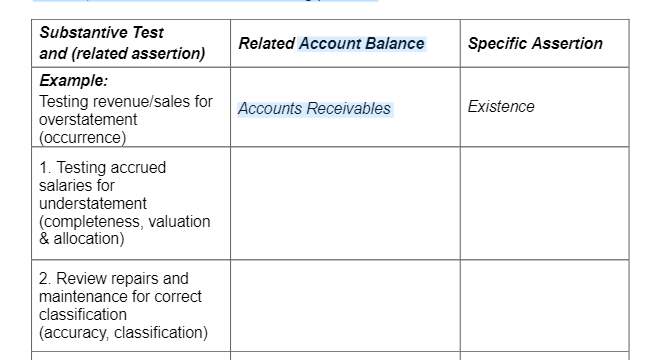

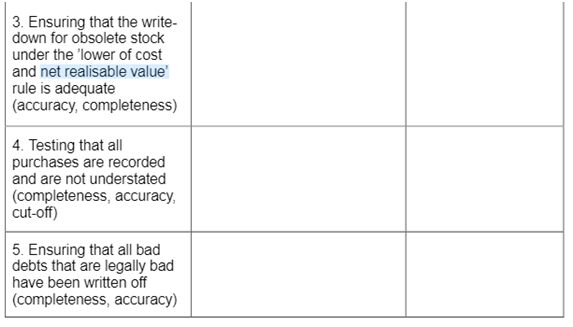

Question: 1. When the auditor conducts substantive tests each side of the journal entry is affected, i.e. double entry accounting. For each of the following substantive

1. When the auditor conducts substantive tests each side of the journal entry is affected, i.e. double entry accounting. For each of the following substantive tests, (and related assertion) indicate one other account, and one specific assertion relating to that account, for which evidence is also being provided

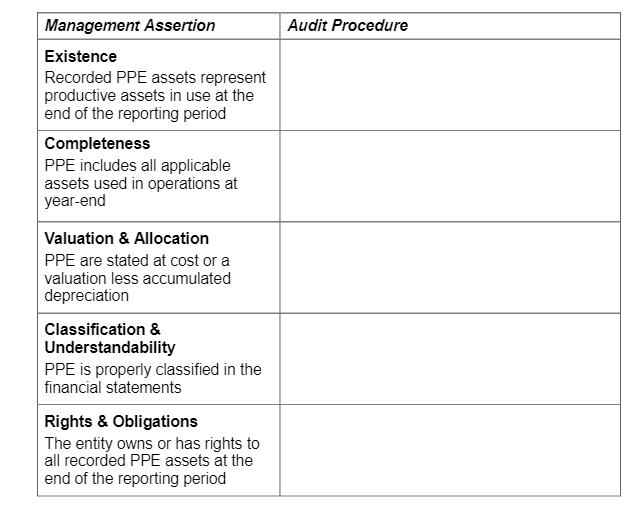

2. Your firm is auditing Rainbow Paints Ltd, a large manufacturer of painting products. You have been assigned the audit of property, plant and equipment (PPE) for the year-ended 30 June 2014.

Rainbow Paints Ltd maintains a computerized fixed assets register. The company?s has three main classes of PPE: (1) Freehold Land & Buildings, (2) Manufacturing Machinery, Plant & Equipment, and (3) Motor Vehicles. You are concerned that the depreciation rates for Motor Vehicles may be inadequate. You are also concerned that the recent revaluation of Freehold Land and Buildings by 20% is too high in the current economic climate.

For each management assertion listed in the table below, provide one substantive audit procedure specifically in relation to one of the above PPE accounts that would be used to gather sufficient appropriate audit evidence.

Substantive Test and (related assertion) Example: Testing revenue/sales for overstatement (occurrence) 1. Testing accrued salaries for understatement (completeness, valuation & allocation) 2. Review repairs and maintenance for correct classification (accuracy, classification) Related Account Balance Accounts Receivables Specific Assertion Existence 3. Ensuring that the write- down for obsolete stock under the 'lower of cost and net realisable value' rule is adequate (accuracy, completeness) 4. Testing that all purchases are recorded and are not understated (completeness, accuracy, cut-off) 5. Ensuring that all bad debts that are legally bad have been written off (completeness, accuracy) Management Assertion Existence Recorded PPE assets represent productive assets in use at the end of the reporting period Completeness PPE includes all applicable assets used in operations at year-end Valuation & Allocation PPE are stated at cost or a valuation less accumulated depreciation Classification & Understandability PPE is properly classified in the financial statements Rights & Obligations The entity owns or has rights to all recorded PPE assets at the end of the reporting period Audit Procedure

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

1 Substantive Tests and Related Assertions 1 Testing accrued salaries for understatement completenes... View full answer

Get step-by-step solutions from verified subject matter experts