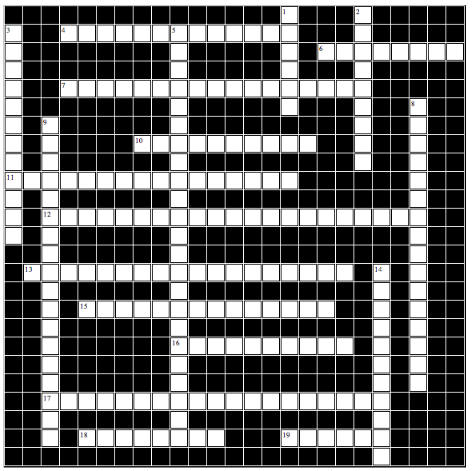

Question: Activity 1: Crossword Puzzle Across 4. Ratio measuring how expensive a company's stock price is compared to EPS (2 words) 6. Shares bought back from

Activity 1: Crossword Puzzle

| Across 4. Ratio measuring how expensive a company's stock price is compared to EPS (2 words) 6. Shares bought back from investors 7. Solvency ratio that measures how debt boosts ROA to increase ROE (2 words) 10. If three-for-one, an Investor holding 100 shares before holds 300 shares after (2 words) 11. Net income not yet distributed as dividends (2 words) 12. First time sale of stock to the public (3 words) 13. Statement reporting changes in shares outstanding, earnings, and the distribution of earnings (2 words) I5. Ratio measuring profitability from the shareholders' perspective (3 words) 16. Maximum number of shares permitted to be issued 17. Ratio measuring the ability to pay periodic interest payments (3 words) 18. legal value assigned to each share of stock; usually less than the market price of the stock (2 words) 19. Type of stock that all corporations most issue | Down 1. Shares sold to Investors 2. Shares receiving dividends before common shares; usually carrying a dividend rate 3. Per share amount of dividends paid annually (2 words) 5. Amounts received in excess of par (4 words) 8. Amount of net income earned by each share of stock (3 words) 9. Total amount paid4n for shares of stock by investors (2 words) 14. Shares held by investors; Issued shares less treasury shares |

ACTIVITY 2 STATEMENT OF STOCKHOLDERS' EQUITY?TYPES OF STOCK

Purpose:

? Identify three types of stock.

? Identify the number of shares authorized, issued, and outstanding.

? Compute the total cost of contributed capital and the average cost per share.

The Statement of Stockholders' Equity provides information about changes in a company's stockholders' equity, including contributed capital and retained earnings. It helps investors understand the structure of a company's ownership.

? Contributed capital (CC) includes amounts paid-in (contributed) by stockholders to purchase the stock of a corporation. There are two types of stock: common stock and preferred stock. Each corporation must issue common stock, whereas preferred stock is optional.

? When originally issued, amounts received from investors are recorded in two separate accounts?the Par Value account and an Additional Paid-in-Capital account. Par Value is a legal value assigned to each share of stock upon incorporation, which must be recorded separately in the financial statements. Additional Paid-In-Capital (APIC) is the amount received in excess of par.

| Par Value +Additional Paid in Capital +Total Issue Price of Stock |

Refer to the Statement of Stockholders' Equity for American Eagle Outfitters, Inc. and accompanying notes on page 107 to answer the following questions.

Q1 For AEO the Par Value account is titled (Common Stock / Contributed Capital) and is $0. per share, while the Additional Paid-in-Capital account is titled (Common Stock / Contributed Capital).

Q2 On January 29, 2011 $_________ thousand was reported as Common Stock (Par) and $___________thousand reported as Contributed Capital (APIC) for total contributions of $__________thousand for issued shares.

Q3 During FYE January 28, 2012, AEO repurchased common stock, which (increased / decreased) total stockholders' equity by $__________thousand and reissued treasury stock which (Increased / decreased) total stockholders' equity by $______________thousand.

Upon incorporation, a company is authorized (by the state of incorporation) to Issue a designated number of shares to investors. Sometimes corporations buy back shares of stock that have been issued; these are referred to as Treasury Stock. Shares outstanding are the total number of shares actually held by investors at a given time, equaling shares issued less shares of treasury stock.

| Shares issued Treasury shares = Shares outstanding |

Q4 On January 29, 2011 for preferred stock there are (0 / 5,000 / 600,000) thousand shares authorized, (0 / 5,000 / 600,000) thousand shares issued, and (0 / 5,000 / 600,000) thousand shares outstanding. Whereas for common stock on January 29, 2011 there are (600,000/ 249,566 / 194,366) thousand shares authorized, (600,000 / 249,566 / 194,366) thousand shares issued, and (600,000 / 249,566 / 194,366) thousand shares outstanding. [Refer re Note (1)]

Q5 On January 29, 2011 for common stock:$__________ thousand shares issued -___________thousand shares in treasury [Refer to Note (2)] =_______ thousand shares outstanding.

Q6 On January 29, 2011 there are thousand shares of common stock issued for a total contribution of ($2,496 / $546,597 / $549,093 / $938,023) thousand, averaging ($3 / $17) per share. Also, there are _______________thousand shares of treasury stock with a total cost of ($2,496 / $546,597 / $549,093 / $938,023) thousand, averaging ($3 / $17) per share.

Why does the average cost of issued common shares differ from the average cost of treasury shares?

Activity 3 Ratio Analysis

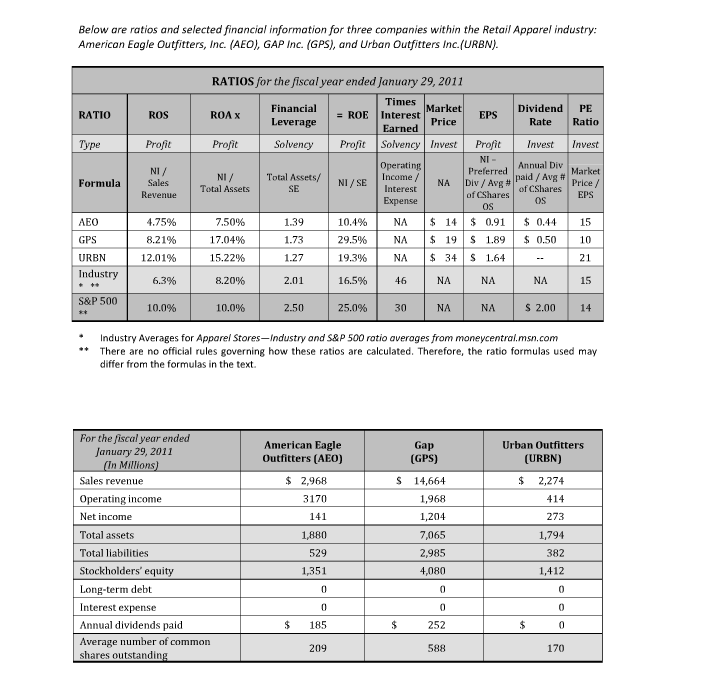

Refer to the ratios and selected financial information for three companies within the Retail Apparel Industry: American Eagle Outfitters, Inc. (AEO), GAP Inc. (GPS), and Urban Outfitters inc. on the previous page to answer the following questions.

Q.1 The strongest ROS ratio is reported by (AEO / GPS / URBN). ROS expresses net income as a percentage of (revenue / expenses / assets) and measures the firm's ability to control (revenue / expenses /net Income) to keep (revenue / expenses / net Income) high.

Q.2 Meaning is added to a ratio by comparing it to industry norms because success may vary by industry. An ROA ratio greater than the industry norm is reported by (AEO / GPS / URBN), indicating these companies have (greater / less) overall profitability than average within the Apparel Store Industry.

Q.3 The greatest financial leverage ratio of is reported by (AEO / GPS / URBN), which will boost ROA almost (1 / 2 / 4) times to increase (ROS / ROE / EPS / PE). The average Financial Leverage for the S&P 500 is (higher / lower) than the average for the Apparel Store Industry, indicating that the S&P 500 stocks carry (more / less) debt on average than the Apparel Store Industry.

Q.4 The strongest ROE is reported by (AEO / GPS / URBN), with ROA contributing 17% to ROE and Financial Leverage contributing _% to ROE. Therefore, (ROA / Financial Leverage) is the primary driver of ROE.

Q .5 A Times Interest Earned ratio greater than 4 generally indicates the ability to make interest payments. Companies within the Apparel Store Industry, on average, (have / don't have) the ability to make interest payments.

Q.6 The higher EPS is reported by (MO / URBN), indicating (AEO / URBN / can't tell) is more profitable. EPS (does / does not) compare profitability among companies, but (does / does not) reflect shareholders' proportionate share of earnings.

Q.7 The companies paying dividends are (AEO / GPS / URBN). AEO is paying out approximately (25%/ 50% / 75%) of this year's EPS. The dividend rate of AEO is (more / less) than the average for the S&P 500.

| Bargain PE |

Q.8 Urban Outfitter's PE Ratio of___________ indicates there is $_________ of market price for each $1 of EPS. As measured by the PE ratio, (MO / GPS / URBN) stock is the most expensive. Using the PE ratio scale immediately above, MO has (bargain-priced / moderately-priced / expensive) stock when compared to EPS. A higher PE ratio indicates (superior / Inferior/ can't tell) stock.

Q.9 Overall, which company has the greatest profitability? (MO / GPS / URBN) How can you tell?

Which company is assuming the greatest financial risk? (AEO/ GPS / URBN) How can you tell?

Which company would you invest in? (AEO / GPS / URBN) Why?

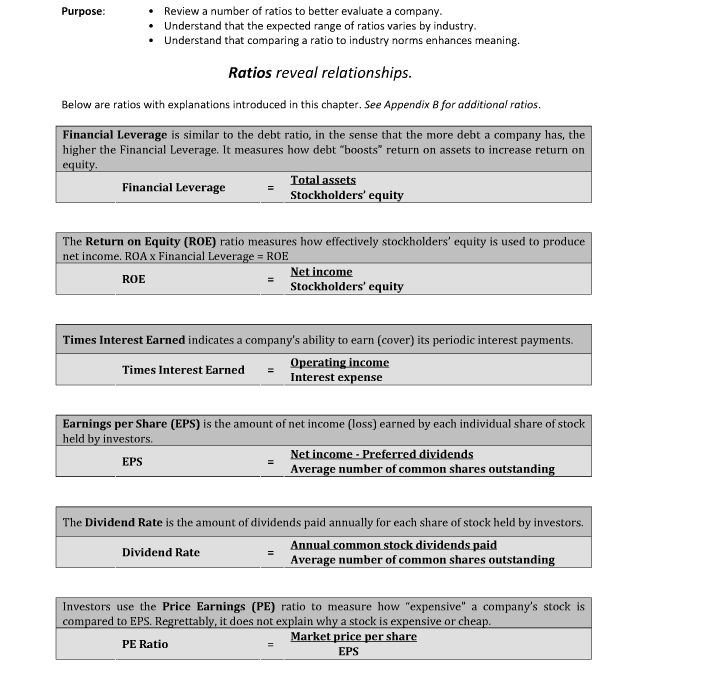

F 13 12 15 18 10 16 19 14 Review a number of ratios to better evaluate a company. Understand that the expected range of ratios varies by industry. Understand that comparing a ratio to industry norms enhances meaning. Ratios reveal relationships. Below are ratios with explanations introduced in this chapter. See Appendix B for additional ratios. Financial Leverage is similar to the debt ratio, in the sense that the more debt a company has, the higher the Financial Leverage. It measures how debt "boosts" return on assets to increase return on equity. Purpose: Financial Leverage Total assets Stockholders' equity The Return on Equity (ROE) ratio measures how effectively stockholders' equity is used to produce net income. ROA x Financial Leverage = ROE ROE Net income Stockholders' equity Times Interest Earned indicates a company's ability to earn (cover) its periodic interest payments. Times Interest Earned Operating income Interest expense Earnings per Share (EPS) is the amount of net income (loss) earned by each individual share of stock held by investors. EPS Net income - Preferred dividends Average number of common shares outstanding The Dividend Rate is the amount of dividends paid annually for each share of stock held by investors. Annual common stock dividends paid Dividend Rate Average number of common shares outstanding Investors use the Price Earnings (PE) ratio to measure how "expensive" a company's stock is compared to EPS. Regrettably, it does not explain why a stock is expensive or cheap. Market price per share PE Ratio EPS Below are ratios and selected financial information for three companies within the Retail Apparel industry: American Eagle Outfitters, Inc. (AEO), GAP Inc. (GPS), and Urban Outfitters Inc. (URBN). RATIO Type Formula AEO GPS URBN Industry S&P 500 ROS Profit NI/ Sales Revenue 4.75% 8.21% 12.01% 6.3% 10.0% For the fiscal year ended January 29, 2011 (In Millions) RATIOS for the fiscal year ended January 29, 2011 Times = ROE Interest Earned Profit Solvency Invest Sales revenue Operating income Net income Total assets Total liabilities ROA X Profit NI/ Total Assets 7.50% 17.04% 15.22% 8.20% Stockholders' equity Long-term debt Interest expense Annual dividends paid Average number of common shares outstanding 10.0% Financial Leverage Solvency Total Assets/ SE 1.39 1.73 1.27 2.01 2.50 $ 2,968 3170 141 1,880 529 1,351 NI / SE $ 10.4% 29.5% 19.3% 16.5% American Eagle Outfitters (AEO) 0 0 185 209 Operating Income / Interest Expense 25.0% 30 Profit NI- Preferred Div / Avg # of CShares OS $14 $0.91 $19 $ 1.89 $ 34 S 1.64 46 Market Price $ Gap (GPS) Industry Averages for Apparel Stores-Industry and S&P 500 ratio averages from moneycentral.msn.com ** There are no official rules governing how these ratios are calculated. Therefore, the ratio formulas used may differ from the formulas in the text. $ 14,664 1,968 1,204 7,065 2,985 4,080 EPS 0 0 252 588 Dividend PE Rate Ratio Invest Invest Annual Div paid / Avg # of CShares Os $ 0.44 $ 0.50 $ 2.00 $ 1,794 382 1,412 Market Price / EPS Urban Outfitters (URBN) 2,274 414 273 0 0 0 15 10 21 15 170 14

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Sure lets work through the crossword puzzle and questions one by one Activity 1 Crossword Puzzle Across 4 Price Earnings 6 Treasury 7 Financial Leverage 10 Stock Split 11 Retained Earnings 12 Initial ... View full answer

Get step-by-step solutions from verified subject matter experts