As a financial advisor, you are assigned a new client who is considering investing in one of

Fantastic news! We've Found the answer you've been seeking!

Question:

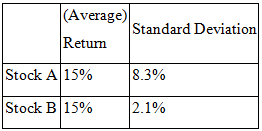

As a financial advisor, you are assigned a new client who is considering investing in one of two stocks, A or B. The table below shows information about the performance of stocks A and B last year.

1. What factors would you consider as a financial advisor in making decisions about the data above?

2. Based on these factors, what stock would you recommend to the client?

3. What reasons will you convey to your client to justify your decision in recommending this stock?

4. How will this recommendation impact the client?

Related Book For

Posted Date: