Question: Audit planning requires that the auditor consider possible inventory errors or frauds that might occur that could affect the financial statements. For each of the

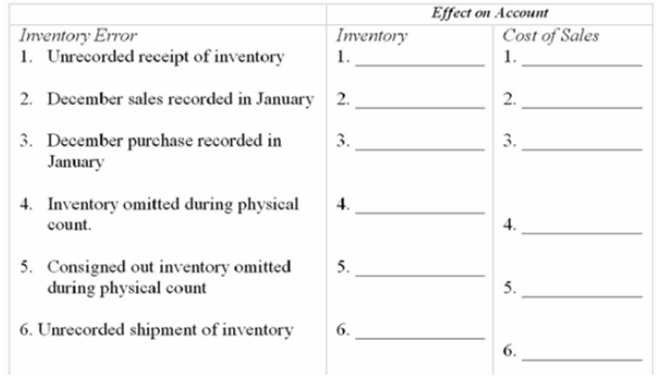

Audit planning requires that the auditor consider possible inventory errors or frauds that might occur that could affect the financial statements. For each of the types of inventory errors listed in the following table, indicate what would be the possible effect in the inventory and cost of sales accounts: overstated, understated, or no effect.

Inventory Error 1. Unrecorded receipt of inventory 2. December sales recorded in January 3. December purchase recorded in January 4. Inventory omitted during physical count. 5. Consigned out inventory omitted during physical count 6. Unrecorded shipment of inventory Inventory 1. 2. 3. 4. 5. 6. Effect on Account Cost of Sales 1. 2. 3. 4. 5. 6.

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

To analyze the possible effects on the inventory and cost of sales accounts due to the given inventory errors well consider each error individually an... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

60970c48e053a_27440.pdf

180 KBs PDF File

60970c48e053a_27440.docx

120 KBs Word File