Question: Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is $3.75 per pound. The company produced 15,000 units that

Bellingham Company produces a product that requires 2.5 standard pounds per unit. The standard price is $3.75 per pound. The company produced 15,000 units that required 36,000 pounds, which were purchased at $4.00 per pound. The product also requires 4 standard hours per unit at a standard hourly rate of $20 per hour. The 15,000 units required 61,800 hours at an hourly rate of $19.85 per hour. In addition, the standard variable overhead cost per unit is $0.90 per hour and the actual variable factory overhead was $52,770. Finally, the standard fixed overhead cost per unit is $1.15 per hour at 58,000 hours, which is 100% of normal capacity. Assume that Bellingham sold 15,000 units at $172 per unit.

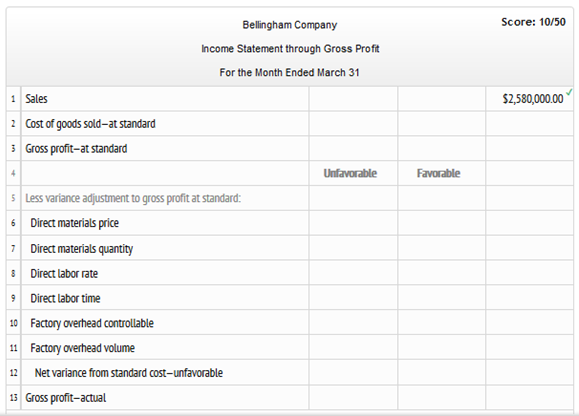

Prepare a income statement through gross profit for Bellingham Company. Enter all amounts as positive numbers except favorable variances.

Prepare a income statement through gross profit for Bellingham Company for the month ended March 31. Assume that Bellingham sold 15,000 units at $172 per unit. Enter all amounts as positive number except favorable variances.

1 Sales 2 Cost of goods sold-at standard 3 Gross profit-at standard 4 Bellingham Company Income Statement through Gross Profit For the Month Ended March 31 5 Less variance adjustment to gross profit at standard: 6 Direct materials price 7 s Direct labor rate 9 Direct labor time 10 Factory overhead controllable 11 Factory overhead volume 12 Net variance from standard cost-unfavorable 13 Gross profit-actual Direct materials quantity Unfavorable Favorable Score: 10/50 $2,580,000.00

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

To prepare the income statement through gross profit for Bellingham Company we need to calculate several variances and then determine the actual gross profit Below are the detailed stepbystep calculat... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

609440d26903e_24654.pdf

180 KBs PDF File

609440d26903e_24654.docx

120 KBs Word File