Question: Let assume that today is January 1 2018. The rate of inflation is expected to be 4% throughout 2018. However, increased government deficits and

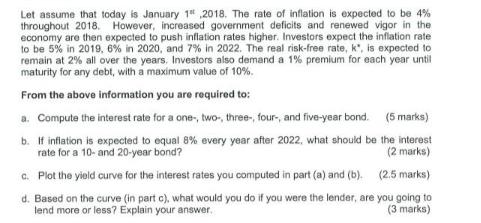

Let assume that today is January 1 2018. The rate of inflation is expected to be 4% throughout 2018. However, increased government deficits and renewed vigor in the economy are then expected to push inflation rates higher. Investors expect the inflation rate to be 5% in 2019, 6% in 2020, and 7% in 2022. The real risk-free rate, k", is expected to remain at 2% all over the years. Investors also demand a 1% premium for each year until maturity for any debt, with a maximum value of 10%. From the above information you are required to: a. Compute the interest rate for a one-, two, three-, four-, and five-year bond. (5 marks) b. If inflation is expected to equal 8% every year after 2022, what should be the interest rate for a 10- and 20-year bond? (2 marks) c. Plot the yield curve for the interest rates you computed in part (a) and (b). (2.5 marks) d. Based on the curve (in part c), what would you do if you were the lender, are lend more or less? Explain your answer. you going to (3 marks)

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

a To compute the interest rates for one two three four and fiveyear bonds we can use the Fisher equation which relates nominal interest rates real int... View full answer

Get step-by-step solutions from verified subject matter experts