Question: For each stock state whether it is overvalued, undervalued or correctly priced if the risk-free rate of return is 3.2% and the market risk premium

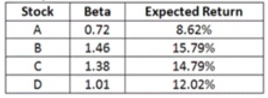

For each stock state whether it is overvalued, undervalued or correctly priced if the risk-free rate of return is 3.2% and the market risk premium is 8.4%. Also state your investment strategy (buy, sell, or hold).

Stock A B D Beta 0.72 1.46 1.38 1.01 Expected Return 8.62% 15.79% 14.79% 12.02%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To determine whether each stock is overvalued undervalued or correctly priced we can use the Capital ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock