Robert and Mary file a joint tax return for 2015 with adjusted gross income of $34,000. Robert

Fantastic news! We've Found the answer you've been seeking!

Question:

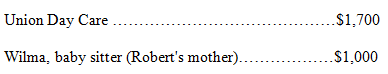

Robert and Mary file a joint tax return for 2015 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2015. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John:

What is the amount of the child and dependent care credit they should report on their tax return for 2015?

? $459

? $729

? $270

? $675

? None of these choices are correct.

Show transcribed image text

Related Book For

Federal Taxation 2016 Comprehensive

ISBN: 9780134104379

29th edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Posted Date: