Question: Work out this exercise on risk and return, Suppose you observe the following situation as depicted in the table below. If the risk-free rate is

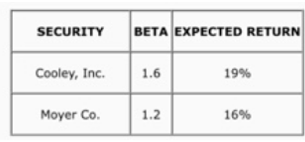

Work out this exercise on risk and return, Suppose you observe the following situation as depicted in the table below. If the risk-free rate is 8%, are these securities correctly priced? What would the risk-free rate have to be is they are correctly priced?

SECURITY Cooley, Inc. Moyer Co. BETA EXPECTED RETURN 1.6 1.2 19% 16%

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

To determine if the securities are correctly priced we can use the Capital Asset Pricing Model CAPM ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

60905dbac2f85_21657.pdf

180 KBs PDF File

60905dbac2f85_21657.docx

120 KBs Word File