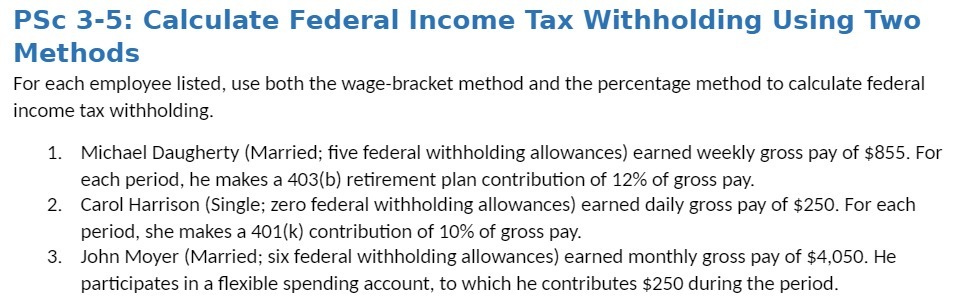

Question: PSc 3-5: Calculate Federal Income Tax Withholding Using Two Methods For each employee listed, use both the wagebracket method and the percentage method to calculate

PSc 3-5: Calculate Federal Income Tax Withholding Using Two Methods For each employee listed, use both the wagebracket method and the percentage method to calculate federal income tax withholding. 1. Michael Daugherty (Married; ve federal withholding allowa nces) earned weekly gross pay of $855. For each period, he makes a 403(b} retirement plan contribution of 12% of gross pay. 2. Carol Harrison (Single; zero federal withholding allowances) earned daily gross pay of $250. For each period. she makes a 401(k) contribution of 10% of gross pay. 3. John Moyer (Married; six federal withholding allowances] earned monthly gross pay of $4.050. He participates in a flexible spending account, to which he contributes $250 during the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts