Question: |Question 2| Stubbs Enterprize is considering the following two mutually exclusive projects, each of which require an initial investment of $100,000 and have no salvage

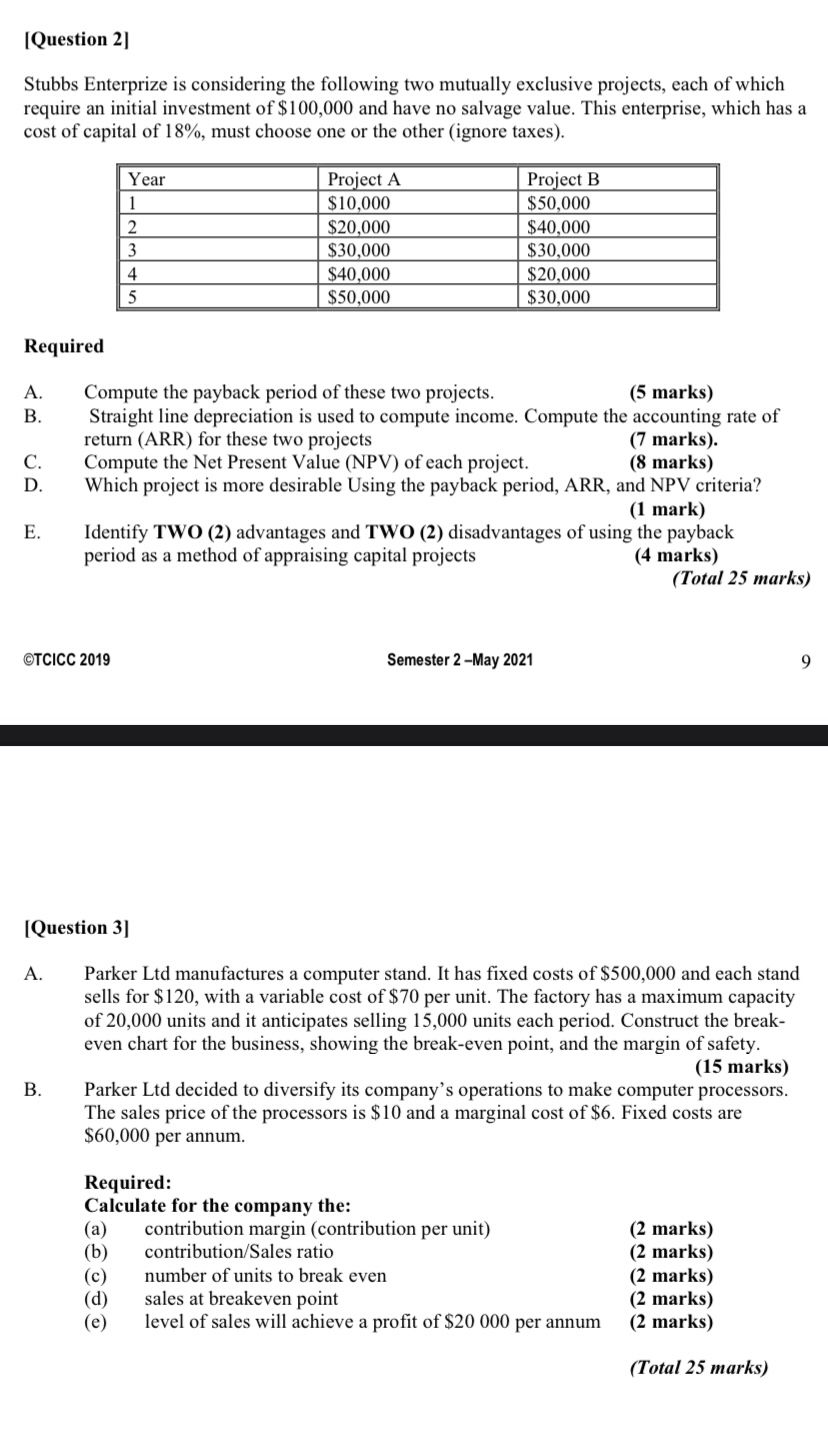

|Question 2| Stubbs Enterprize is considering the following two mutually exclusive projects, each of which require an initial investment of $100,000 and have no salvage value. This enterprise, which has a cost of capital of 18%, must choose one or the other (ignore taxes). [Year |ProjetA |ProjectB | $10,000 $50,000 (3 130,000 $30.000 (4 Ts40,000 $20.000 s [ss50000 $30.000 | Required A. Compute the payback period of these two projects. (5 marks) B. Straight line depreciation is used to compute income. Compute the accounting rate of return (ARR) for these two projects (7 marks). C. Compute the Net Present Value (NPV) of each project. (8 marks) D. Which project is more desirable Using the payback period, ARR, and NPV criteria? (1 mark) E. Identify TWO (2) advantages and TWO (2) disadvantages of using the payback period as a method of appraising capital projects (4 marks) (Total 25 marks) @TCICcC 2019 Semester 2 -May 2021 9 [Question 3] A. Parker Ltd manufactures a computer stand. It has fixed costs of $500,000 and each stand sells for $120, with a variable cost of $70 per unit. The factory has a maximum capacity of 20,000 units and it anticipates selling 15,000 units each period. Construct the break- even chart for the business, showing the break-even point, and the margin of safety. (15 marks) B. Parker Ltd decided to diversity its company's operations to make computer processors. The sales price of the processors is $10 and a marginal cost of $6. Fixed costs are $60,000 per annum. Required: Calculate for the company the: (a) contribution margin (contribution per unit) (2 marks) (b) contribution/Sales ratio (2 marks) (c) number of units to break even (2 marks) (d) sales at breakeven point (2 marks) (e) level of sales will achieve a profit of $20 000 per annum (2 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts