Question: Innis Investments manages funds for a number of companies and wealthy clients. The investment strategy is tailored to each client's needs. For a new client,

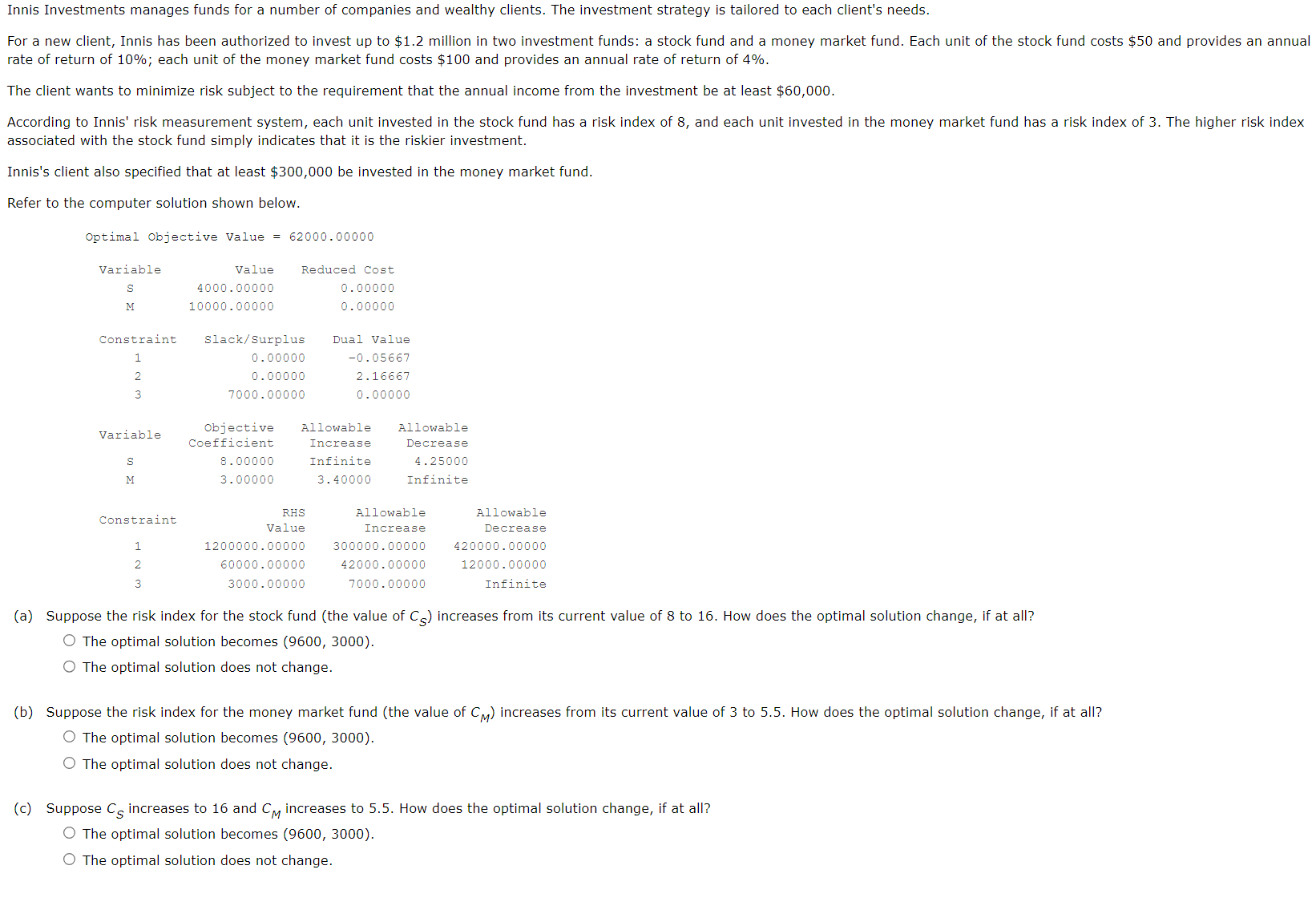

Innis Investments manages funds for a number of companies and wealthy clients. The investment strategy is tailored to each client's needs. For a new client, Innis has been authorized to invest up to $1.2 million in two investment funds: a stock fund and a money market fund. Each unit of the stock fund costs $50 and provides an annual rate of return of 10%; each unit of the money market fund costs $100 and provides an annual rate of return of 4% The client wants to minimize risk subject to the requirement that the annual income from the investment be at least $60,000. According to Innis' risk measurement system, each unit invested in the stock fund has a risk index of 8, and each unit invested in the money market fund has a risk index of 3. The higher risk index associated with the stock fund simply indicates that it is the riskier investment. Innis's client also specified that at least $300,000 be invested in the money market fund. Refer to the computer solution shown below. optimal Objective Valus = 62000.00000 Varia Value Red M 10000.00000 k/Surplus (a) Suppose the risk index for the stock fund (the value of CS) increases from its current value of 8 to 16. How does the optimal solution change, if at all? The optimal solution becomes (9600, 3000). O The optimal solution does not change. (b) Suppose the risk index for the money market fund (the value of C,)) increases from its current value of 3 to 5.5. How does the optimal solution change, if at all? O The optimal solution becomes (600, 3000). O The optimal solution does not change. (c) Suppose Cg increases to 16 and C,, increases to 5.5. How does the optimal solution change, if at all? O The optimal solution becomes (9600, 3000). O The optimal solution does not change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts