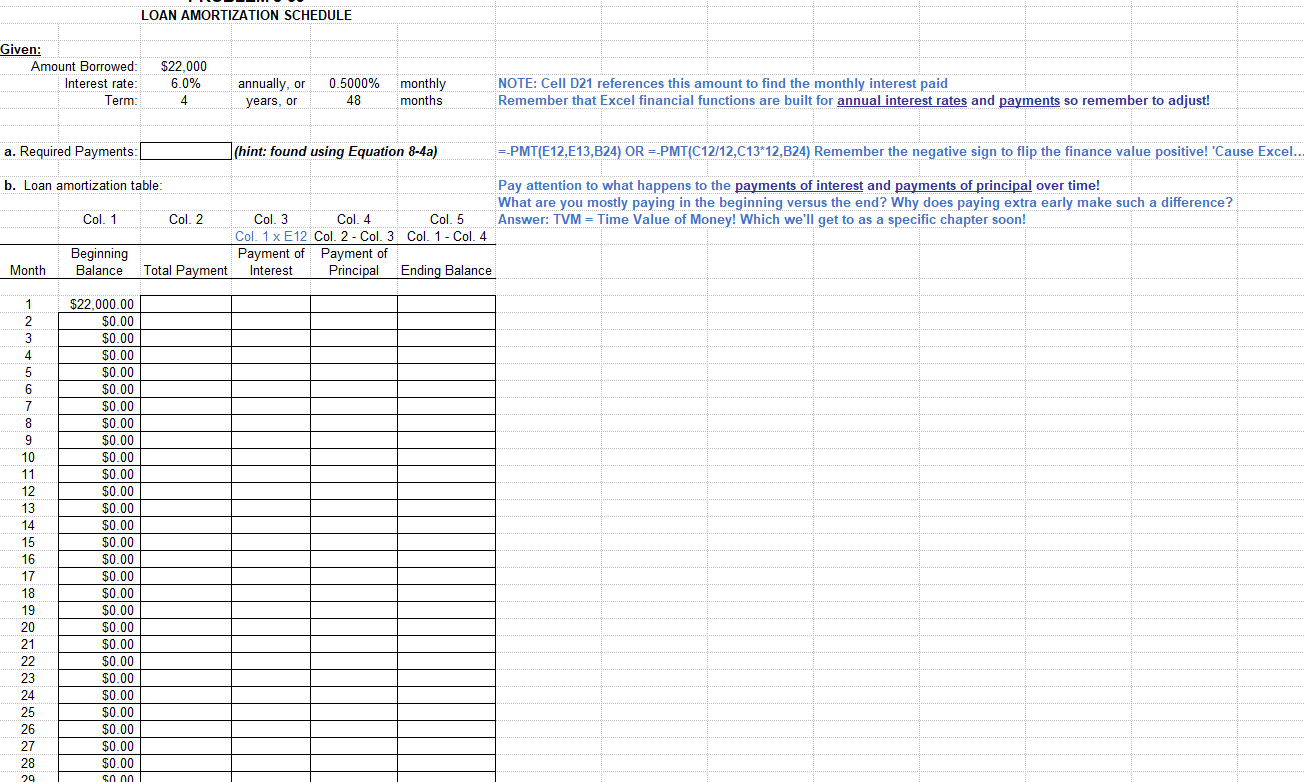

Question: LOAN AMORTIZATION SCHEDULE Given: Amount Borrowed: $22,000 Interest rate: 6.0% annually, or 0.5000% monthly NOTE: Cell D21 references this amount to find the monthly interest

LOAN AMORTIZATION SCHEDULE Given: Amount Borrowed: $22,000 Interest rate: 6.0% annually, or 0.5000% monthly NOTE: Cell D21 references this amount to find the monthly interest paid Term: 4 years, or 48 months Remember that Excel financial functions are built for annual interest rates and payments so remember to adjust! a. Required Payments: (hint: found using Equation 8-4a) =-PMT(E12,E13,B24) OR =-PMT(C12/12,C13*12,B24) Remember the negative sign to flip the finance value positive! 'Cause Excel. b. Loan amortization table: Pay attention to what happens to the payments of interest and payments of principal over time! What are you mostly paying in the beginning versus the end? Why does paying extra early make such a difference? Col. 1 Col. 2 Col. 3 Col. 4 Col. 5 Answer: TVM = Time Value of Money! Which we'll get to as a specific chapter soon! Col. 1 x E12 Col. 2 - Col. 3 Col. 1 - Col. 4 Beginning Payment of Payment of Month Balance Total Payment Interest Principal Ending Balance $22,000.00 $0.00 50.00 50.00 50.00 50.00 $0.00 $0.00 $0.00 10 $0.00 11 $0.00 12 60.00 13 10.00 14 50.00 15 $0.00 16 $0.00 17 $0.00 18 $0.00 $0.00 20 $0.00 50.00 22 $0.00 23 $0.00 $0.00 50.00 $0.00 $0.00 28 $0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts