Question: 3. IWI is interested 1n acquiring FINA Inc. Both are public corporations traded on the New York Stock Exchange. FINA has a market capital value

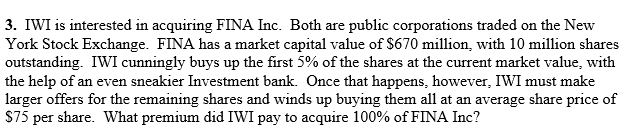

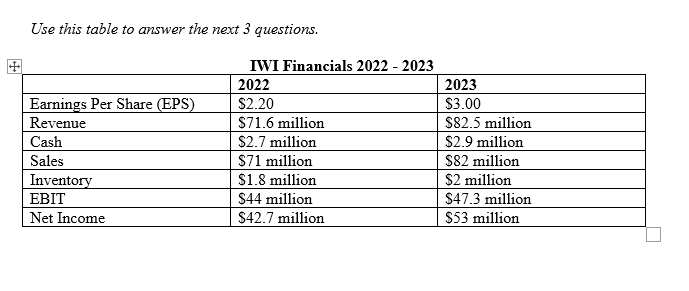

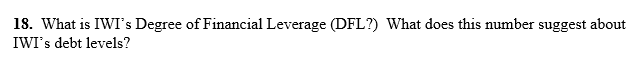

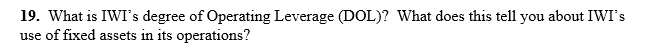

3. IWI is interested 1n acquiring FINA Inc. Both are public corporations traded on the New York Stock Exchange. FINA has a market capital value of $670 million. with 10 million shares outstanding. TWI cunningly buys up the first 5% of the shares at the current market value, with the help of an even sneakier Investment bank. Once that happens, however, [WI must make larger offers for the remaining shares and winds up buving them all at an average share price of 575 per share. What premium did ITWT pay to acquire 100% of FINA Inc? Use this table to answer the next 3 questions. IWI Financials 2022 - 2023 2022 2023 Earnings Per Share (EPS) $2.20 $3.00 Revenue $71.6 million $82.5 million Cash $2.7 million $2.9 million Sales $71 million $82 million Inventory $1.8 million $2 million EBIT $44 million $47.3 million Net Income $42.7 million $53 million18. What is IWI's Degree of Financial Leverage (DFL?) What does this number suggest about IWI's debt levels?19. What is IWI's degree of Operating Leverage (DOL)? What does this tell you about IWI's use of fixed assets in its operations?20. GW Inc has a Degree of Combined Leverage (DCL) of 1.1. Compare this to FINA Inc's DCL of 1.9 and predict which company would have the most risk in the face of a recession? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts