Question: Purpose of the homework: 1. Students can learn an example of the credit scoring model for loan application. 2. Students can learn how to improve

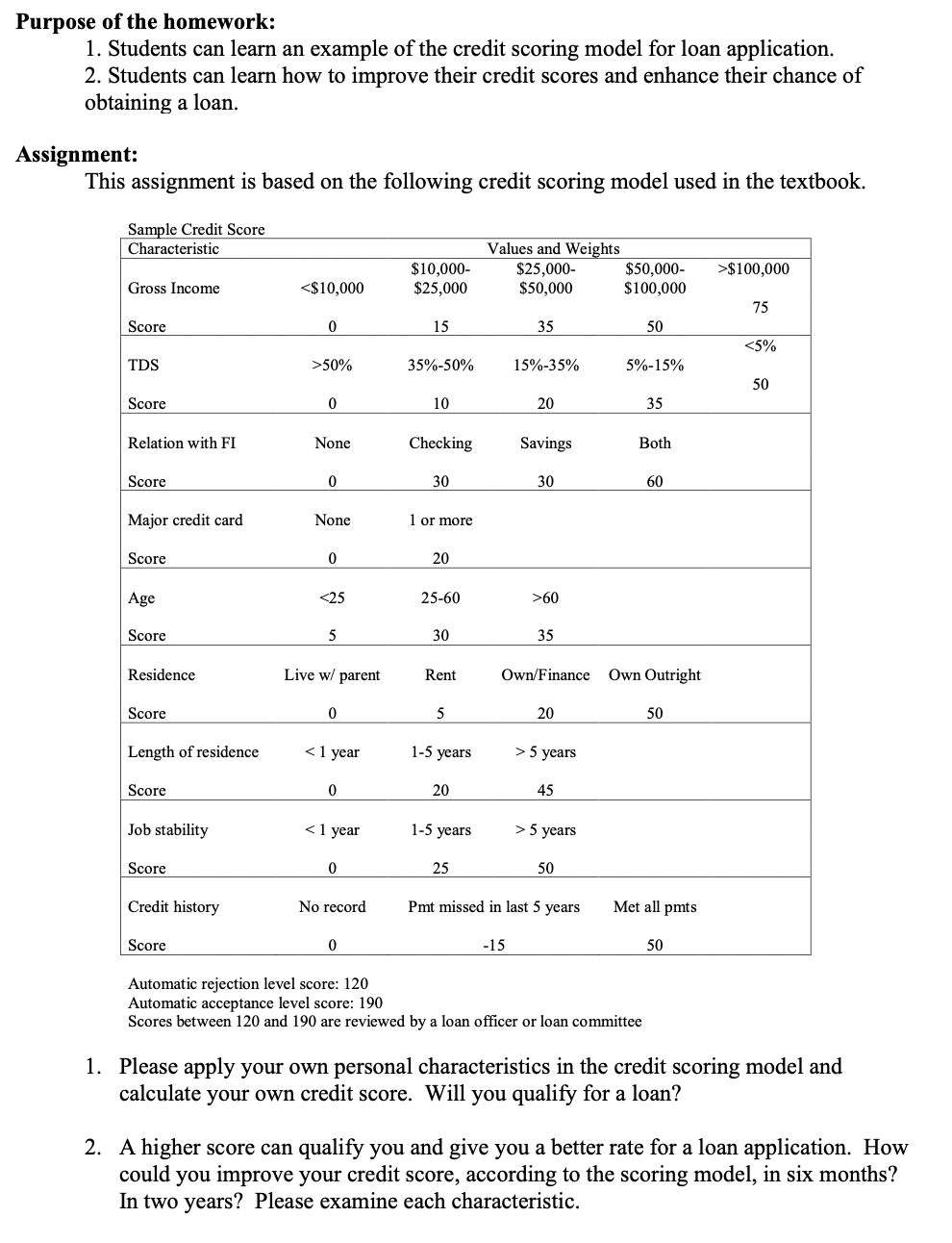

Purpose of the homework: 1. Students can learn an example of the credit scoring model for loan application. 2. Students can learn how to improve their credit scores and enhance their chance of obtaining a loan. Assignment: This assignment is based on the following credit scoring model used in the textbook. Sample Credit Score Characteristic Values and Weights $10,000- $25,000- $50,000- >$100,000 Gross Income 50% 35%-50% 15%-35% 5%-15% 50 Score 0 10 20 35 Relation with FI None Checking Savings Both Score 0 30 30 60 Major credit card None 1 or more Score 0 20 Age 60 Score 5 30 35 Residence Live w/ parent Rent Own/Finance Own Outright Score 0 5 20 50 Length of residence 5 years Score 0 20 45 Job stability 5 years Score 0 25 50 Credit history No record Pmt missed in last 5 years Met all pmts Score 0 -15 50 Automatic rejection level score: 120 Automatic acceptance level score: 190 Scores between 120 and 190 are reviewed by a loan officer or loan committee 1. Please apply your own personal characteristics in the credit scoring model and calculate your own credit score. Will you qualify for a loan? 2. A higher score can qualify you and give you a better rate for a loan application. How could you improve your credit score, according to the scoring model, in six months? In two years? Please examine each characteristic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts