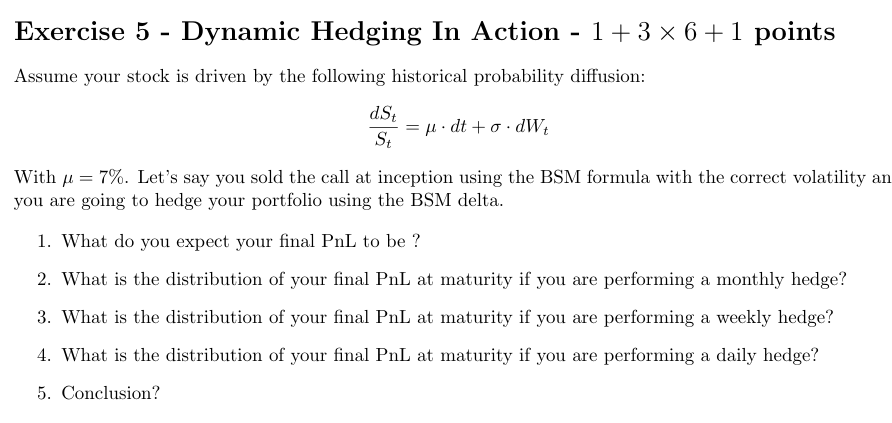

Question: Exercise 5 - Dynamic Hedging In Action - 1+ 3 x 6 + 1 points Assume your stock is driven by the following historical probability

Exercise 5 - Dynamic Hedging In Action - 1+ 3 x 6 + 1 points Assume your stock is driven by the following historical probability diffusion: dSt St H . dt to . dWt With a = 7%. Let's say you sold the call at inception using the BSM formula with the correct volatility an you are going to hedge your portfolio using the BSM delta. 1. What do you expect your final PnL to be ? 2. What is the distribution of your final PL at maturity if you are performing a monthly hedge? 3. What is the distribution of your final PL at maturity if you are performing a weekly hedge? 4. What is the distribution of your final PL at maturity if you are performing a daily hedge? 5. Conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts