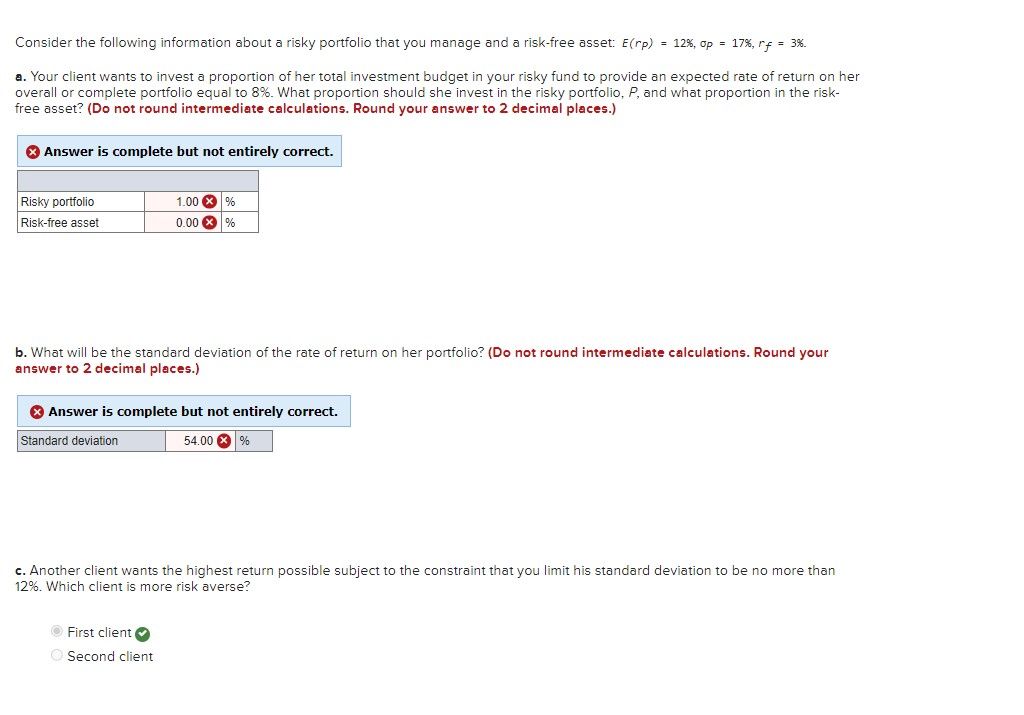

Question: Consider the following information about a risky portfolio that you manage and a risk-free asset: (rp) = 12% op = 17%, rg = 3% a.

Consider the following information about a risky portfolio that you manage and a risk-free asset: (rp) = 12% op = 17%, rg = 3% a. Your client wants to invest a proportion of her total investment budget in your risky fund to provide an expected rate of return on her overall or complete portfolio equal to 8%. What proportion should she invest in the risky portfolic, P, and what proportion in the risk- free asset? (Do not round intermediate calculations. Round your answer to 2 decimal places.) ) Answer is complete but not entirely correct. [ Risky portfolio 1006 | % Risk-ree asset 000 |% b. What will be the standard deviation of the rate of return on her portfolic? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Standard deviafion 54.00 @ |% c. Another client wants the highest return possible subject to the constraint that you limit his standard deviation to be no more than 12%. Which client is more risk averse? First client ) Second client

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts