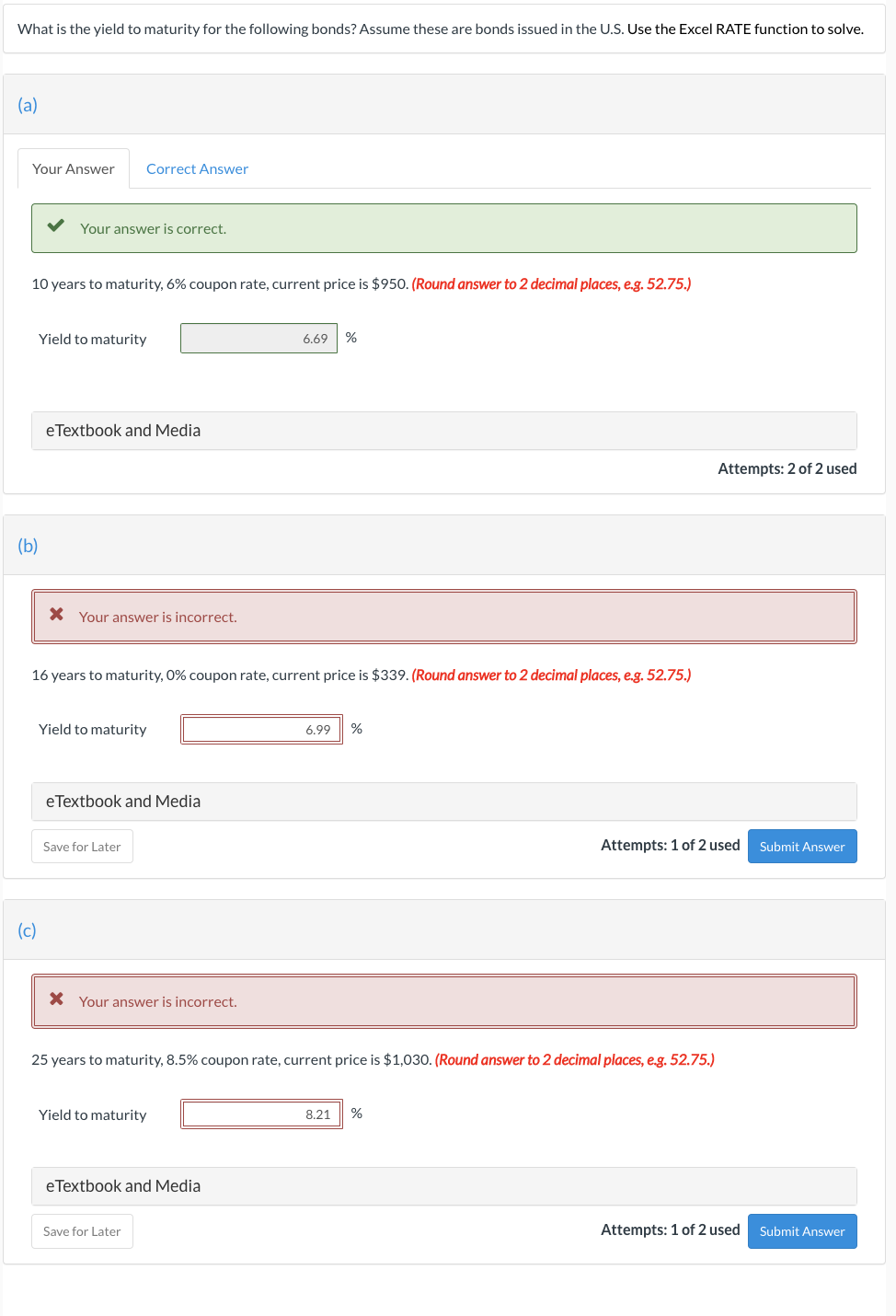

Question: What is the yield to maturity for the following bonds? Assume these are bonds issued in the U.S. Use the Excel RATE function to solve.

What is the yield to maturity for the following bonds? Assume these are bonds issued in the U.S. Use the Excel RATE function to solve. (a) Your Answer Correct Answer Your answer is correct. 10 years to maturity, 6% coupon rate, current price is $950. (Round answer to 2 decimal places, e.g. 52.75.) Yield to maturity 6.69 % eTextbook and Media Attempts: 2 of 2 used (b) * Your answer is incorrect. 16 years to maturity, 0% coupon rate, current price is $339. (Round answer to 2 decimal places, e.g. 52.75.) Yield to maturity 6.99 % eTextbook and Media Save for Later Attempts: 1 of 2 used Submit Answer (c) X Your answer is incorrect. 25 years to maturity, 8.5% coupon rate, current price is $1,030. (Round answer to 2 decimal places, e.g. 52.75.) Yield to maturity 8.21 % eTextbook and Media Save for Later Attempts: 1 of 2 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts