Question: Berkshire Controllers usually finances its engineering projects with a combination of debt and equity capital. The resulting MARR ranges from a low of 4% per

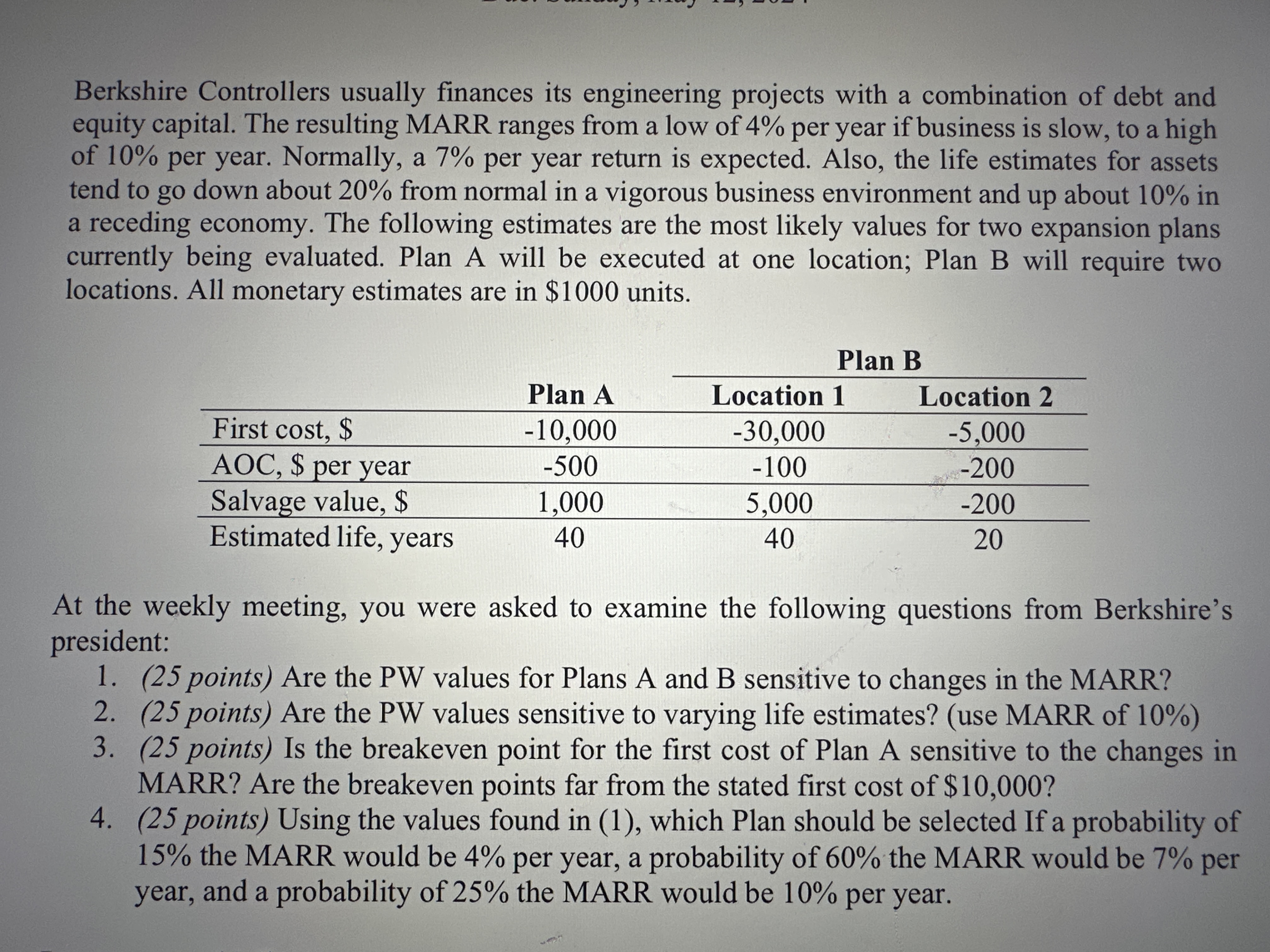

Berkshire Controllers usually finances its engineering projects with a combination of debt and equity capital. The resulting MARR ranges from a low of 4% per year if business is slow, to a high of 10% per year. Normally, a 7% per year return is expected. Also, the life estimates for assets tend to go down about 20% from normal in a vigorous business environment and up about 10% in a receding economy. The following estimates are the most likely values for two expansion plans currently being evaluated. Plan A will be executed at one location; Plan B will require two locations. All monetary estimates are in $1000 units. Plan B Plan A Location 1 Location 2 First cost, $ 10,000 -30,000 -5,000 AOC, $ per year -500 -100 -200 Salvage value, $ 1,000 5,000 -200 Estimated life, years 40 40 20 At the weekly meeting, you were asked to examine the following questions from Berkshire's president: 1. (25 points) Are the PW values for Plans A and B sensitive to changes in the MARR? 2. (25 points) Are the PW values sensitive to varying life estimates? (use MARR of 10%) 3. (25 points) Is the breakeven point for the first cost of Plan A sensitive to the changes in MARR? Are the breakeven points far from the stated first cost of $10,000? 4. (25 points) Using the values found in (1), which Plan should be selected If a probability of 15% the MARR would be 4% per year, a probability of 60% the MARR would be 7% per year, and a probability of 25% the MARR would be 10% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts