Question: Question 1 0 /5 points The cost of preferred stock is computed the same as the: * @ pretax cost of debt. rate of return

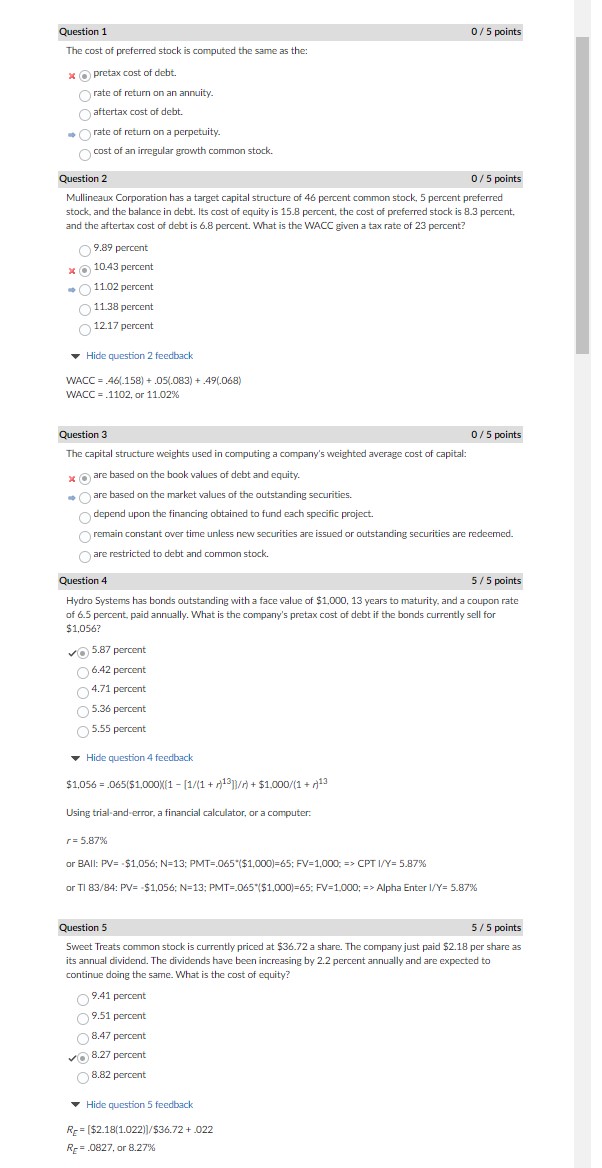

Question 1 0 /5 points The cost of preferred stock is computed the same as the: * @ pretax cost of debt. rate of return on an annuity. aftertax cost of debt. rate of return on a perpetuity. cost of an irregular growth common stock. Question 2 0 /5 points Mullineaux Corporation has a target capital structure of 46 percent common stock, 5 percent preferred stock, and the balance in debt. Its cost of equity is 15.8 percent, the cost of preferred stock is 8.3 percent, and the aftertax cost of debt is 6.8 percent. What is the WACC given a tax rate of 23 percent? 9.89 percent x 10.43 percent 11.02 percent 11.38 percent 12.17 percent Hide question 2 feedback WACC = . 461.158) + .05(.083) + .49(.068) WACC = .1102, or 11.02% Question 3 0 /5 points The capital structure weights used in computing a company's weighted average cost of capital: * are based on the book values of debt and equity. are based on the market values of the outstanding securities. depend upon the financing obtained to fund each specific project. remain constant over time unless new securities are issued or outstanding securities are redeemed. are restricted to debt and common stock. Question 4 5 /5 points Hydro Systems has bonds outstanding with a face value of $1,000, 13 years to maturity, and a coupon rate of 6.5 percent, paid annually. What is the company's pretax cost of debt if the bonds currently sell for $1,056? VO 5.87 percent 6.42 percent 4.71 percent 5.36 percent 5.55 percent Hide question 4 feedback $1,056 = .065($1,000*[1 - [1/(1 + /)131)/r) + $1.000/(1 + 13 Using trial-and-error, a financial calculator, or a computer. r= 5.87% or BAII: PV= -$1,056; N=13; PMT=.065*($1,000)=65; FV=1,000 => CPT I/Y= 5.87% or TI 83/84: PV= -$1,056; N=13; PMT=.065 ($1,000)=65: FV=1.000; => Alpha Enter I/Y= 5.87% Question 5 5 /5 points Sweet Treats common stock is currently priced at $36.72 a share. The company just paid $2.18 per share as its annual dividend. The dividends have been increasing by 2.2 percent annually and are expected to continue doing the same. What is the cost of equity? 9.41 percent 951 percent 8.47 percent VO 8.27 percent 8.82 percent Hide question 5 feedback RE= [$2.18(1.022)]/$36.72 + .022 R-= .0827, or 8.27%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts