Question: FIN 320 Final Project Financial Assumptions When a business needs to invest, it's important to look at financial options. This is true for simple purchases,

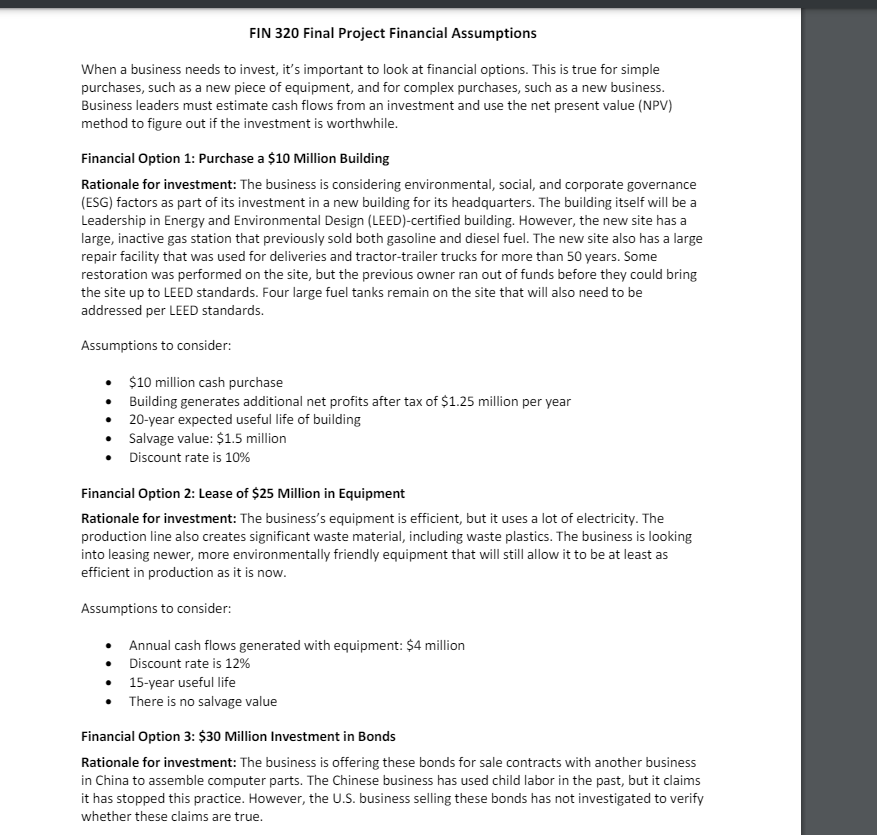

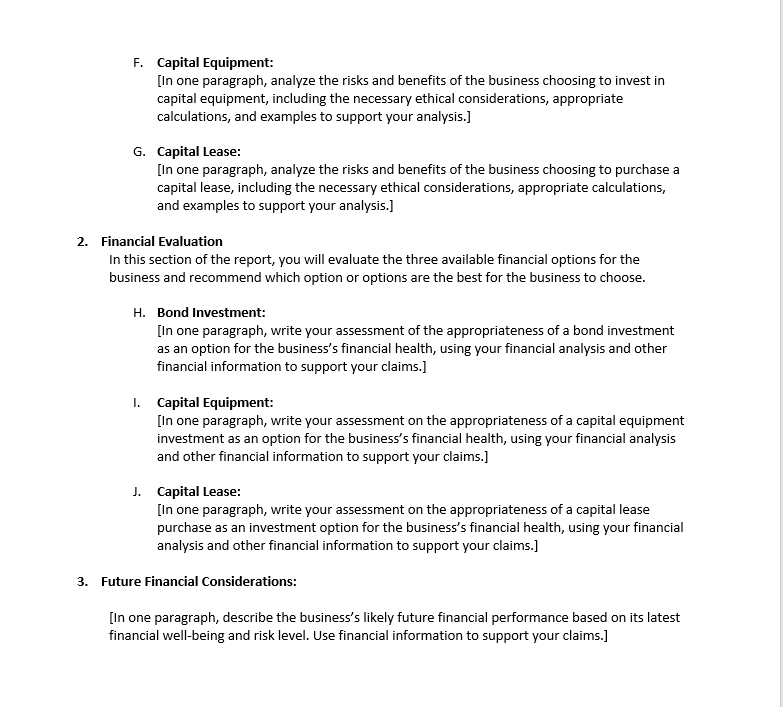

FIN 320 Final Project Financial Assumptions When a business needs to invest, it's important to look at financial options. This is true for simple purchases, such as a new piece of equipment, and for complex purchases, such as a new business. Business leaders must estimate cash flows from an investment and use the net present value (NPV) method to figure out if the investment is worthwhile. Financial Option 1: Purchase a $10 Million Building Rationale for investment: The business is considering environmental, social, and corporate governance (ESG) factors as part of its investment in a new building for its headquarters. The building itself will be a Leadership in Energy and Environmental Design (LEED)-certified building. However, the new site has a large, inactive gas station that previously sold both gasoline and diesel fuel. The new site also has a large repair facility that was used for deliveries and tractor-trailer trucks for more than 50 years. Some restoration was performed on the site, but the previous owner ran out of funds before they could bring the site up to LEED standards. Four large fuel tanks remain on the site that will also need to be addressed per LEED standards. Assumptions to consider: s 510 million cash purchase & Building generates additional net profits after tax of $1.25 million per year & 20-year expected useful life of building * Salvage value: 51.5 million s Discount rate is 10% Financial Option 2: Lease of $25 Million in Equipment Rationale for investment: The business's equipment is efficient, but it uses a lot of electricity. The production line also creates significant waste material, including waste plastics. The business is locking into leasing newer, more environmentally friendly equipment that will still allow it to be at least as efficient in production as it is now. Assumptions to consider: * Annual cash flows generated with equipment: 54 million s Discountrateis 12% s 15-year useful life s There is no salvage value Financial Option 3: 530 Million Investment in Bonds Rationale for investment: The business is offering these bonds for sale contracts with another business in China to assemble computer parts. The Chinese business has used child labor in the past, but it claims it has stopped this practice. However, the U.S. business selling these bonds has not investigated to verify whether these claims are true. Assumptions to consider: * 10-year bond 8% coupon % Priced at a discount: 595 # Discount rate is 9% F. Capital Equipment: [In one paragraph, analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.] G. Capital Lease: [In one paragraph, analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.] Financial Evaluation In this section of the report, you will evaluate the three available financial options for the business and recommend which option or options are the best for the business to choose. H. Bond Investment: [In one paragraph, write your assessment of the appropriateness of a bond investment as an option for the business's financial health, using your financial analysis and other financial information to support your claims.] I. Capital Equipment: [In one paragraph, write your assessment on the appropriateness of a capital equipment investment as an option for the business's financial health, using your financial analysis and other financial information to support your claims.] 1. Capital Lease: [In one paragraph, write your assessment on the appropriateness of a capital lease purchase as an investment option for the business's financial health, using your financial analysis and other financial information to support your claims.] Future Financial Considerations: [In one paragraph, describe the business's likely future financial performance based on its latest financial well-being and risk level. Use financial information to support your claims.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts